Ways to Help Reduce Risk in Your Portfolio

Sometimes it takes a stock market drop to get investors thinking about how to better protect their downside. An unattended portfolio may have become more aggressive as the stock portion outperformed other asset classes, accounting for more of the overall portfolio value. That's fine as long as stocks keep going up, but conditions can turn quickly. When they do, you may not be prepared— financially or emotionally—to tolerate a sharp decline in your portfolio.

To arm yourself against a potential market downturn, you may want to reexamine your investing strategy through the lens of your current risk appetite and time horizon.

Here are some basics to keep in mind as well as specific tactics to consider for managing risk in your portfolio.

Reassess your risk tolerance

Before you adjust your holdings, make sure your financial plan is up to date. Ask yourself:

- Does your portfolio mix still match your risk tolerance?

- Does your risk tolerance still match your goals?

For example, a more conservative stance—such as shifting from stocks into bonds and other fixed income investments—makes sense the closer you get to retirement. Indeed, those in or near retirement may want to keep enough cash on hand to cover a year's worth of spending needs (after accounting for other sources of income, including Social Security), and cash or short-term bonds for an additional one to three years' worth of spending needs. This degree of financial flexibility can help you manage unforeseen expenses without having to liquidate stocks under less-than-ideal conditions.

On the flip side, if retirement is at a comfortable distance, you shouldn't be too spooked by swings in the market. You may have sufficient time to wait out a downturn and potentially capture the longer-term gains that stocks have historically delivered.

Rebalance your portfolio

Your portfolio should match your appetite for risk, so if market volatility makes you want to jump ship, you may need to revisit your allocation. Equally important, you want to make sure your intended asset allocation matches your actual one. If it doesn't, consider selling overweight positions and buying underweight ones to rebalance your portfolio.

When you fail to rebalance as stocks climb, your equity allocation can become a larger part of your portfolio—which could result in greater losses if stocks fall.

Remain focused

By all means, reassess and rebalance, but don't forget to stay focused while doing so. Trying to dump investments when both the market and your confidence are dropping disregards the adage "buy low, sell high."

If the head-for-the-exits feeling is familiar, you may be the kind of investor who would benefit from a more conservative portfolio as part of your long-term strategy, not just as a response to a market upset. At the end of the day, though, staying invested to support your goals can help you avoid making decisions in the heat of the moment, and even bad market timing beats getting out or not investing at all.

Are you in, or are you out?

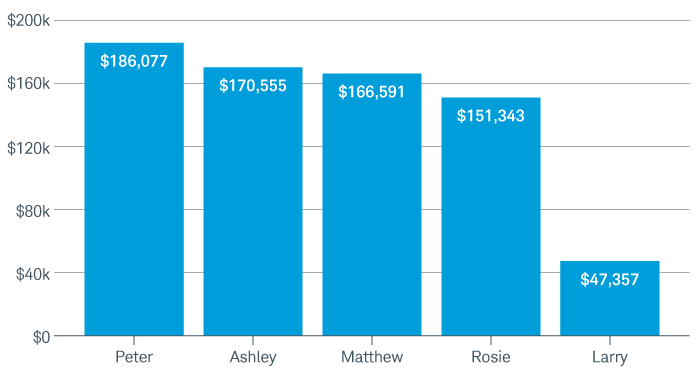

Time in the market is more important than timing the market. Here's how four hypothetical investors fared after 20 years of investing $2,000 annually, based on when and how they invested.

Ending wealth for four types of investors over all 20-year periods (1926–2023)

Source: Schwab Center for Financial Research.

Each individual invested $2,000 annually in a hypothetical portfolio that tracks the S&P 500® Index from 2005-2024. The individual who never bought stocks invested in a hypothetical portfolio that tracks the lbbotson U.S. 30-day Treasury Bill Index. Past performance is no guarantee of future results. Indexes are unmanaged, do not incur fees or expenses and cannot be invested in directly. The examples are hypothetical and provided for illustrative purposes only. They are not intended to represent a specific investment product and investors may not achieve similar results. Dividends and interest are assumed to have been reinvested, and the examples do not reflect the effects of taxes, expenses, or fees. Had fees, expenses or taxes been considered, returns would have been substantially lower.

Investor A's portfolio outperformed the others, but timing the market is difficult. That said, Investor B had greater success investing immediately compared to both Investor C, who bought at the wrong time, and Investor D, who avoided stock completely.

Review your holdings

After reassessing your plan and rebalancing your portfolio, you can make other minor adjustments to potentially lower your portfolio risk. Specifically, you could bump up your short-term holdings of less volatile asset classes and reserve riskier ones for your long-term allocation. For example:

Consider more . . .

- Cash and cash investments: Generally speaking, your upside with cash is limited, but it retains its value (before inflation) in the face of even the steepest market declines. And cash tends not to move in lockstep with changes in the prices of other kinds of assets. Cash is seen as a defensive asset, and cash investments can benefit from rising interest rates when the Federal Reserve is in a hiking cycle. Plus, it's great way to hold an emergency fund.

- Treasuries: Backed by the full faith and credit of the U.S. government, Treasury bonds are generally considered a safe fixed income investment. Short-term Treasuries (which mature in a year or less) can provide income with low risk while those that mature in the intermediate term (i.e., less than 10 years) and longer term often experience a boost in price as interest rates move lower.

Consider less . . .

- Sub-investment grade or high-yield bonds: These assets often provide greater yield, but with it comes higher risk. Sub-investment grade bonds are more prone to default than those rated BBB or higher.1

- Emerging-market stocks: Investing in emerging markets offers an opportunity for potential growth and higher returns. However, they also come with risk—for example, political unrest, lack of resources, or an insufficient workforce can cause volatility.

- Small-cap stocks: Publicly traded companies with a market capitalization ranging from roughly $300 million to $2 billion tend to be more volatile than their large-cap counterparts, particularly during a downturn.

- Concentrated positions: Like overallocation, overconcentration in any one or more positions can leave your portfolio vulnerable to risk. Downturns can sometimes hit some sections of the market harder than others, and if your portfolio is concentrated in those areas, it could suffer as a result.

Reduce portfolio risk on your terms

There are several ways to dial back the risk in your portfolio, but do so in appropriate manner. For example, taking a more aggressive tactical approach might be right if you have the inclination, time, and skills to watch the market closely. But if you're focused on the long term, one way to help your portfolio stay on track is to maintain an asset allocation that matches your time horizon and risk tolerance. Add or trim exposure to certain asset classes in response to your needs and goals—not because of short-term market gyrations, and follow a strategy you can live with through the ups and downs.

1The Moody's investment grade rating scale is Aaa, Aa, A, and Baa, and the sub-investment-grade scale is Ba, B, Caa, Ca, and C. Standard and Poor's investment grade rating scale is AAA, AA, A, and BBB and the sub-investment-grade scale is BB, B, CCC, CC, and C. Ratings from AA to CCC may be modified by the addition of a plus (+) or minus (–) sign to show relative standing within the major rating categories. Fitch's investment-grade rating scale is AAA, AA, A, and BBB and the sub-investment-grade scale is BB, B, CCC, CC, and C.