Stocks Dip on Weak GDP, Sharper Price Growth

Published as of: February 20, 2026, 9:14 a.m. ET

Listen to this update

Listen here or subscribe to the Schwab Market Update in your favorite podcast app.

| The markets | Last price | Change | % change |

|---|---|---|---|

| S&P 500® Index | 6,861.89 | -19.42 | -0.28% |

| Dow Jones Industrial Average® | 49,395.16 | -267.50 | –0.54% |

| Nasdaq Composite® | 22,682.73 | -70.90 | -0.31% |

| 10-year Treasury yield | 4.07% | +0.01 | -- |

| U.S. Dollar Index | 97.94 | +0.27 | +0.03% |

| Cboe Volatility Index® | 21.01 | +0.78 | +3.86% |

| WTI Crude Oil | $66.16 | -$0.27 | -0.41% |

| Bitcoin | $66,840 | -$365 | -0.56% |

(Friday market open) Stocks extended earlier losses with tech under increasing pressure after a key inflation reading came in slightly warmer than expected and fourth quarter economic growth slowed substantially. December Personal Consumption Expenditures (PCE) prices rose 0.4% month over month, above the consensus of 0.3% and November's 0.2%. Core PCE excluding food and energy costs also rose 0.4%, in line with consensus and also above the 0.2% November level. The government's first estimate for gross domestic product (GDP) landed at just 1.4% when Wall Street had expected 3%.

"The government shutdown appeared to be the key driver of the weaker-than-expected GDP report," said Collin Martin, head of fixed income research and strategy at the Schwab Center for Financial Research (SCFR). "Since its impact is tough to forecast, the markets appear to be taking it in stride given that personal consumption came in-line with expectations for the quarter. Core PCE came in a bit hot on both a month-over-month and year-over-year basis, contrasting with last week's softer CPI report." Separately, investors brace for a possible Supreme Court ruling later this morning or next week on President Trump's tariffs. A decision striking them down might be seen as slightly bullish by market participants but wouldn't affect all tariffs or prevent the administration from attempting alternative restrictions on trade.

Major indexes broke a three-day winning streak Thursday in cautious trading ahead of today's data but remain on pace for light weekly gains. Mounting tensions between the U.S. and Iran and fresh worries about credit markets contributed to Thursday's lower finish. Crude oil hit fresh six-month highs, powering energy shares but grounding airline stocks. Next Wednesday's earnings from Nvidia (NVDA) could return focus to the battered tech group as investors closely watch the AI giant's margins amid rising industry costs, and big-box earnings roll on with Home Depot (HD) next Tuesday and Lowe's (LOW) on Wednesday.

To get the Schwab Market Update in your inbox every morning, subscribe on Schwab.com.

Three things to watch

- PCE/GDP deeper dive: Year-over-year headline PCE growth was 2.9%, well above the Fed's 2% target and up from 2.8% in November, while core annual growth reached 3%. Consensus was 2.8% for headline PCE and 3% for core. The culprit appeared to be goods prices, which rose 0.4% in December from 0.1% in November. Personal spending rose 0.4% in December, a sign that consumers continued opening their wallets. "With economic growth still likely growing at or above trend and inflationary pressures still present, we expect the Fed to remain on hold until we see more persistent signs of disinflation," my colleague Martin said. GDP fell from 4.4% the prior quarter, though the government makes two more estimates before the fourth-quarter reading becomes official. With the fourth quarter estimate now in, GDP last year rose 2.2%, down from 2.8% in 2024. "Details under the GDP hood show solid business investment, positive consumption—though slower relative to Q3—and a significant pullback in government spending," said Kevin Gordon, head of macro research and strategy at SCFR.

- AI software concerns hit private credit: Blue Owl Capital (OWL) dropped 6% Thursday after it said it was selling $1.4 billion in assets from credit funds so it can return capital and pay down debt, while permanently halting redemptions at one of the funds, Reuters reported. Shares of other asset management firms including Blackstone (BX) and Ares Management (ARES) also fell on the news. Private credit came under scrutiny recently after the software sector sold off on AI competition concerns, as many smaller software companies appear highly leveraged. The Blue Owl news compounded those concerns.

- Bullish sentiment declines: Individual investor optimism about the stock market hit 12-week lows Wednesday, MarketWatch reported, citing a survey by the American Association of Individual Investors. Just 34.5% of respondents were bullish about equities over the next six months, the lowest reading since late November. Of note, the November low in sentiment occurred after the S&P 500 Index crumbled more than 4% over the previous month. This week's survey came after a mostly flat start to the year for the index, but signs of strength underneath as cyclical sectors like industrials, energy, and materials led. This suggests investors might be focused on the surface rather than taking a deeper look at trends below. Though a tech rebound is likely required to return the Nasdaq and S&P 500 back to last year's strength, the S&P 500 Equal Weight index (SPXEW), which weighs all components equally, posted a new all-time high just last week and is up 9.2% from November lows. The S&P 500 is up just 4% over the same stretch.

On the move

- Grail (GRAL) plunged 46% ahead of the open after saying its multi-cancer screening test Galleri didn't lead to a statistically significant reduction in stage 3 and 4 cancer in a large trial, Barron's reported.

- Akamai Technologies (AKAM) slid almost 10% this morning after the cybersecurity and cloud company saw profit decline in its latest quarter despite higher revenue.

- Opendoor Technologies (OPEN) rocketed 19% early Friday after the online homebuying platform reported quarterly revenue above Wall Street's consensus.

- AppLovin (APP) climbed 4.5% after Bloomberg reported the company plans to introduce its own social media platform after its bid for TikTok failed.

- Super Micro Computer (SMCI) rolled up 8% gains Thursday in what appeared to be a technically driven rally. There was no fresh news.

- Deckers Outdoor (DECK) climbed 1.4% early today after getting an upgrade to buy from hold from an Argus analyst, who noted management recently raised guidance.

- December new home sales loom at 10 a.m. ET after pending home sales for January fell to an all-time low according to data released yesterday.

- Only three of 11 S&P 500 sectors ended higher Thursday, led by the defensive utilities group and followed by energy, which received a boost from crude. Industrials also were green thanks partly to solid results from Deere. Info tech continued struggling, pulled down by a drop in chip stocks and pressure from the software side.

More insights from Schwab

Fed minutes, economic data assessed: The latest Schwab On Investing podcast features SCFR's chief investment strategist Liz Ann Sonders and chief fixed income strategist Kathy Jones discussing their reactions to this week's Fed minutes and economic data. Sonders pointed out there's a lot of dispersion in the market, with rapid-fire rotations likely to persist.

D.C. shutdown could hit air travel: Though a partial government shutdown hasn't had much impact on markets so far, it could begin to at some point. "Transportation Security Administration (TSA) agents could start staging 'sick outs' at some point in the standoff, potentially impacting air travel—a key pressure point to watch," said Michael Townsend, managing director of legislative and regulatory affairs, Schwab, in his latest Washington: What to Watch Now column. He's also watching a housing measure under debate in Congress, and retirements in the House.

Chart of the day

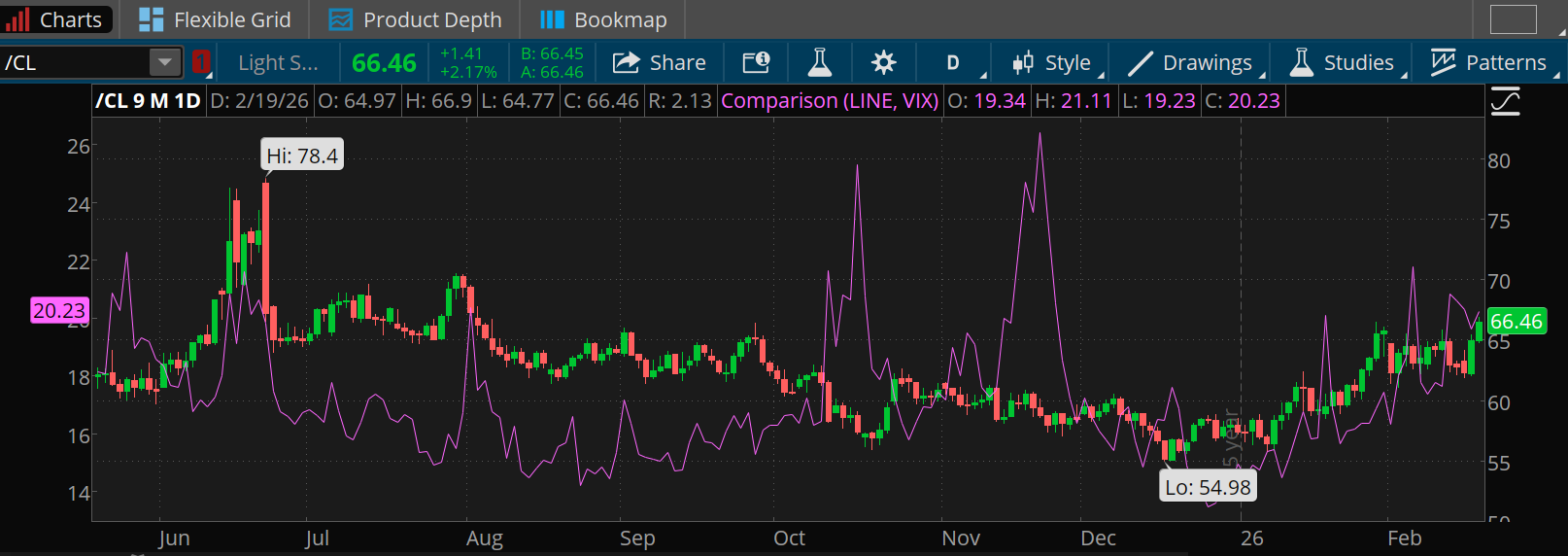

Data source: CME Group, Cboe. Chart source: thinkorswim® platform.

Past performance is no guarantee of future results.

For illustrative purposes only.

CME crude oil futures (/CL—candlesticks) topped $66 yesterday and set a new 2026 high. The Cboe Volatility Index (VIX—purple line) stayed above its historic average of 20, and has risen in the past with crude. Last June, when Iran tensions also simmered, crude topped above $78 and VIX rose from below 18 to above 21. But VIX also rose numerous times after that even when crude was sliding toward its December lows.

The week ahead

Check out the investors' calendar for a summary of the top economic events and earnings reports on tap this week.

February 23: Expected earnings from Dominion Energy (D).

February 24: January new home sales, February Consumer Confidence, and expected earnings from Home Depot (HD), Alibaba (BABA), American Tower (AMT), and Keurig Dr Pepper (KDP).

February 25: Expected earnings from Nvidia (NVDA), TJX Companies (TJX), Lowe's (LOW), Salesforce (CRM), Synopsys (SNPS), and Snowflake (SNOW).

February 26: Expected earnings from Warner Bros. Discovery (WBD), Vistra (VST), Intuit (INTU), Dell (DELL), Autodesk (ADSK), and CoreWeave (CRWV).

February 27: January Producer Price Index (PPI) and core PPI.