Stocks Resume Descent as War Sends Oil Soaring

Published as of: March 3, 2026, 9:14 a.m. ET

Listen to this update

Listen here or subscribe to the Schwab Market Update in your favorite podcast app.

| The markets | Last price | Change | % change |

|---|---|---|---|

| S&P 500® Index | 6,881.62 | +2.74 | +0.04% |

| Dow Jones Industrial Average® | 48,904.78 | -73.14 | -0.15% |

| Nasdaq Composite® | 22,748.86 | +80.65 | +0.36% |

| 10-year Treasury yield | 4.10% | +0.05 | -- |

| U.S. Dollar Index | 99.18 | +0.81 | +0.83% |

| Cboe Volatility Index® | 26.07 | +4.63 | +21.69% |

| WTI Crude Oil | $76.11 | +$4.88 | +6.85% |

| Bitcoin | $66,955 | -$2,525 | -3.63% |

(Tuesday market open) After a display of resilience Monday, stocks tumbled early today as fighting spread across the Middle East and crude oil spiked again. Iran threatened to block the Strait of Hormuz, where 20% of global oil flows out of the Persian Gulf, raising concerns that a surge in energy prices could lift U.S. inflation and delay rate cuts. Treasury yields, which initially slid when the conflict began edged up this morning and pain afflicted nearly every market sector. Market volatility flared.

Though Middle East fighting is the main focus, days ahead are packed with jobs data, building up to Friday's February nonfarm payrolls report. Those numbers will likely come under intense scrutiny after the economy added less than 200,000 jobs all last year before a revival to January's 130,000 growth. Jobs growth can be key to consumer spending, and solid gains for shares of Target (TGT) and Best Buy (BBY) following their earnings early today turned attention back toward that key metric. The consumer firms are followed later today by cybersecurity firm CrowdStrike (CRWD), putting focus back on the battered software sector, while chip giant Broadcom (AVGO) opens its books tomorrow.

On Monday, most major indexes finished flat to higher despite war headlines and rising oil prices. This might reflect investors understanding that historically, these geopolitical events often lead to a quick pullback in stocks that doesn't necessarily last, though past isn't precedent. The S&P 500 Index remained huddled in its near-term range, and only four of 11 sectors gained as consumer shares generally buckled under the weight of inflation worries triggered by eight-month crude highs. At the same time, shares of weakened tech and financial stocks appeared to find some dip buying. Volatility resumed early today, with the Cboe Volatility Index (VIX) climbing more than 20% to three-month highs above 25, historically another level that suggests more dramatic choppiness.

(To learn more about possible scenarios for the markets from the war, please see "More insights from Schwab" lower in this article.)

To get the Schwab Market Update in your inbox every morning, subscribe on Schwab.com.

Three things to watch

- Initial volatility suggests market was prepared: The VIX climbed double digits Monday to levels last seen in late November. However, it stayed below 25, a key height and one investors might want to watch today. It appears a lot of hedges were in place heading into the weekend as many market participants apparently anticipated military action considering the long U.S. arms build-up in the Middle East. The markets weren't caught off guard initially but appear prepared for a relatively short-lived conflict. If the war spreads or shows signs of continuing longer term, that could mean a resetting of expectations and possibly more volatility in both VIX and the Move Index, which is sometimes seen as the "VIX for bonds." The Cboe VIX futures complex could be worth checking for signs of how much volatility the market is pricing in ahead. High volatility often goes hand in hand with weaker stocks.

- Earnings focus turns to big boxes, auto parts: This week brings retailers to the forefront as investors await results from a wide array of consumer giants including Target (TGT), Costco (COST), Best Buy (BBY), and Kroger (KR). Investors gave mixed reviews to large retailers like Walmart (WMT) and Home Depot (HD) that reported over the last two weeks, especially considering cautious guidance from Walmart and relatively subdued outlooks on the housing market from Home Depot and Lowe's (LOW). Also, AutoZone's (AZO) earnings today could provide a deeper look at after-market auto demand, a barometer of overall consumer sentiment. U.S. car sales are seen slowing this year, which could be good news for companies that sell replacement parts to drivers trying to keep their jalopies on the road. On the opposite side of the road, CrowdStrike's earnings might provide more insight into the cybersecurity sub-sector of software, which retreated lately amid a general software slump despite bulls' arguments that AI could increase demand for this segment's services.

- AI anxiety reaches new level: Concerns about AI's potential impact on jobs hit a crescendo Friday when Block (XYZ) announced plans to lay off 40% of its workforce. Though the payments company said this was partly due to Covid-era over-hiring, it added it's now moving toward "smaller, highly talented teams using AI to automate more work." This sent shivers through the entire market, capping a month of worries about the jobs climate following last year's disappointing growth. There are fears AI could replace workers in numerous industries as companies use the technology to get leaner. "The surge in AI capital expenditures, slowdown in job growth, and steady consumer spending are all very central to the 'vibepression' term I coined last year, which underscores persistently dour consumer sentiment despite a growing economy," said Kevin Gordon, head of macro research and strategy at the Schwab Center for Financial Research, or SCFR, in his latest analysis. "To me, it's still too early to have high conviction that AI has become the ultimate job disruptor or displacer. The two industries that saw the largest downward revisions to payroll growth in the 2025 benchmark revisions were information (the tech sector) and wholesale trade. There is of course a potential AI effect at play with the former, but likely more of a trade war impact with the latter."

On the move

- U.S. crude oil surged more nearly 5% early today to above $75 per barrel as Middle East violence flared. Attacks on U.S. embassies in the region heightened concerns, and so did spreading conflict in Lebanon between Israel and Hezbollah. Iran's attacks on Gulf countries sparked worries that oil production could be affected, with shipping lanes already affected by the conflict.

- Energy stocks rose again in pre-opening bell trading. Yesterday, energy led all sectors, driven by gains for shares of Exxon Mobil (XOM), ConocoPhillips (COP), and Chevron (CVX).

- The U.S. Dollar Index ($DXY) rose another 0.8% in early trading to above 99 for the first time since January 20. The dollar's strength could reflect so-called "safe haven" buying as investors search for shelters in the storm, though no investment is truly safe. The dollar had dropped to as low as 95 in late January, reinforcing "debasement trade" concerns about U.S. assets.

- As of this morning, the CME FedWatch Tool sees less than 3% odds of a Fed rate cut this month, and odds for a mid-year cut fell sharply from yesterday. Futures trading now anticipates the pause in rates likely lasting until September, penciling in just 37% chances of any rate cut by the Fed's June meeting. July is more of a 50-50 proposition. Investors now see more likelihood of one or two cuts this year, pulling back on chances of three or more. Several Fed speakers are scheduled today, but it's unclear if any will discuss how the war affects rate policy.

- Target climbed 3% in early trading after quarterly results topped expectations for earnings and met the market's thinking on revenue. Guidance slightly exceeded consensus, as well, but comparable sales last quarter dropped 2.5%, a bit more than the 2.4% Wall Street had expected.

- Best Buy popped 10% early today despite revenue growth slightly missing the market's forecast. Earnings per share topped expectations, and same-store sales for the quarter (stores open a year or more) dropped 0.8%. Best Buy's CEO said the industry saw "slightly softer demand" during the holiday quarter. The rally in shares might reflect improved net income, Barron's reported.

- Amazon (AMZN) fell more than 2% early Tuesday. Drone attacks struck the Middle East facilities of Amazon Web Services, media reports said, damaging several.

- Apple (AAPL) fell 0.5% early today as the company prepares for what it calls a "special experience" tomorrow in several cities that could include new product announcements related to Mac and iPad. Apple announced the new iPad Air and iPhone 17e on Monday.

- Tech shares foundered early Tuesday after a strong showing Monday. Yesterday's gains were led by Nvidia (NVDA) as some participants apparently elected to "buy the dip" in battered sectors like tech and financials. However, chip shares fell with other parts of the tech market this morning, and Nvidia didn’t escape the carnage, dropping 2.4% ahead of the open. This could reflect investors choosing to move toward more cautious trading, putting focus on "defensive" sectors like utilities and staples as the session advances.

- United Airlines (UAL), and Delta Air Lines (DAL), and Southwest (LUV) are all down 2% to 3% this morning. Shares fell yesterday amid concerns that the war would cause oil prices to rise and damage travel demand.

- Cruise lines also suffered sharp losses Monday, with double-digit declines for Norwegian Cruise Line (NCLH) in response to lower-than-expected quarterly revenue. Guidance also appeared to disappoint, and other cruise lines fell on spillover pressure as well as Iran fears.

- Consumer-oriented stocks generally lost ground Monday, including 2% losses for Disney (DIS), Wendy's (WEN), Ford (F), Lululemon (LULU), Estee Lauder (EL), home builder and home improvement companies, and department stores. One source of pressure appeared to be ideas that higher gas costs could cause consumers to pull back on spending. Another worry is that the Fed may have less room to lower rates if the war keeps oil prices and inflation elevated.

- Defense industry firms including Lockheed Martin (LMT) and Northrop Grumman (NOC) gained Monday amid concerns the U.S. could run low of military supplies if the conflict persists. This would likely raise demand for products made by defense contractors. Both NOC and LMT were up slightly early today.

- Bitcoin (/BTC), which can be a key indicator of how much risk investors are willing to take, fell 3% this morning. The cryptocurrency managed to buck predictions and put up a rally on Monday.

- Silver and gold both tumbled early today. Gold, often seen as a "safe haven," entered today's session already up nearly 20% year to date, and got a big boost yesterday.

- The 10-year Treasury note yield, which dipped below 3.95% in trading late Sunday on ideas the war might cause "flight to safety" action in the markets, then climbed about 10 basis points during the course of the day Monday and rose again today. Solid ISM manufacturing data was one factor behind this, along with rising crude oil prices. The ISM data itself contained an inflationary warning note as prices paid for February rose dramatically from January. "Not great news on the inflation front," said Kathy Jones, chief fixed income strategist at SCFR.

- With major indexes opening lower, chart watchers have their eyes on the 6,750 to 6,775 area for the S&P 500 Index. This is a range of support that's held for several months, but a serious dip below it could portend additional selling.

More insights from Schwab

Bullish, neutral, and bearish market cases for Iran conflict: At this point, considering the various scenarios about how the current situation could evolve is the best approach, said Chris Ferrarone, head of equity research and strategy at SCFR.

- Under the neutral case of de-escalation and a stable Strait of Hormuz, oil prices are expected to trade in a range around pre-crisis prices, providing a neutral backdrop for global equities and credit markets in this scenario, episodes of volatility are likely to persist as deescalation plays out, Ferrarone said.

- In adverse scenarios involving supply outages or an extended closure of the strait, oil prices could spike well above $100, leading to stagflation risks and heightened financial volatility, Ferrarone said. However, high spare capacity and diversified global supply could reduce the likelihood of catastrophic outcomes, he said.

- A rapid resolution accompanied by a regime collapse in Iran could be a bullish surprise for risk assets—though regime change at this point seems a complicated and uncertain process, he said. In that optimistic scenario, the removal of the geopolitical risk premium could push oil prices lower than their pre-attack price below the prior baseline—and spur rallies in equities, particularly in Asia Pacific and Europe. Safe haven assets would likely decline, and central banks could accelerate rate cuts as energy prices fall, Ferrarone said.

- In the short term, uncertainty is likely to prevail, and investors are likely to react by preparing for an adverse scenario. "Don’t overreact to the news," said Kathy Jones, chief fixed income strategist at SCFR. "A diversified portfolio should be able to withstand volatility in the short term. If investors are not well diversified, it might be time to look at portfolio allocations. But it probably isn't a good time to swing for the fences, given the wide range of potential outcomes. The past isn't necessarily a perfect guide to the future, but previous experience tells us that staying the course during times of heightened global risks, generally, is the right strategy."

Bullish, neutral, and bearish market cases for Iran conflict: At this point, considering the various scenarios about how the current situation could evolve is the best approach, said Chris Ferrarone, head of equity research and strategy at SCFR.

- Under the neutral case of de-escalation and a stable Strait of Hormuz, oil prices are expected to trade in a range around pre-crisis prices, providing a neutral backdrop for global equities and credit markets in this scenario, episodes of volatility are likely to persist as deescalation plays out, Ferrarone said.

- In adverse scenarios involving supply outages or an extended closure of the strait, oil prices could spike well above $100, leading to stagflation risks and heightened financial volatility, Ferrarone said. However, high spare capacity and diversified global supply could reduce the likelihood of catastrophic outcomes, he said.

- A rapid resolution accompanied by a regime collapse in Iran could be a bullish surprise for risk assets—though regime change at this point seems a complicated and uncertain process, he said. In that optimistic scenario, the removal of the geopolitical risk premium could push oil prices lower than their pre-attack price below the prior baseline—and spur rallies in equities, particularly in Asia Pacific and Europe. Safe haven assets would likely decline, and central banks could accelerate rate cuts as energy prices fall, Ferrarone said.

- In the short term, uncertainty is likely to prevail, and investors are likely to react by preparing for an adverse scenario. "Don’t overreact to the news," said Kathy Jones, chief fixed income strategist at SCFR. "A diversified portfolio should be able to withstand volatility in the short term. If investors are not well diversified, it might be time to look at portfolio allocations. But it probably isn't a good time to swing for the fences, given the wide range of potential outcomes. The past isn't necessarily a perfect guide to the future, but previous experience tells us that staying the course during times of heightened global risks, generally, is the right strategy."

401(k) primer: In the latest Schwab Financial Decoder episode, learn about the fundamentals of retirement savings and how the 401(k) is crucial in supporting long-term retirement saving and investing.

Resources for volatile markets: Turbulent market conditions can make anyone worried about their portfolio, and Schwab offers several perspectives that provide ideas to keep in mind at such times:

Market Volatility: What to Do During Turbulence

Bear Market: Now What?

Market Volatility in Retirement: Are You Prepared?

Navigating the Markets: Tariffs and Trade

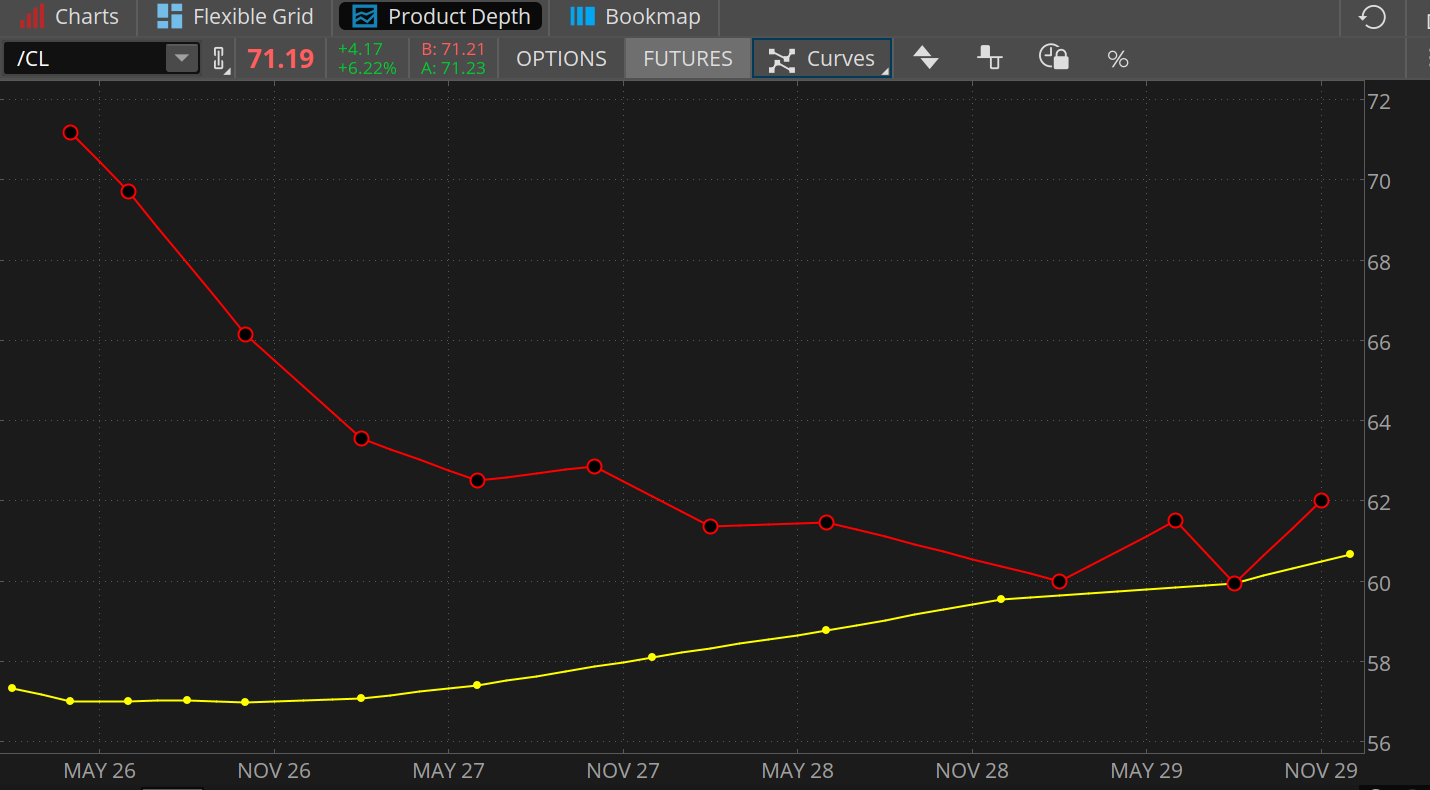

Chart of the day

Data source: CME Group. Chart source: thinkorswim® platform.

Past performance is no guarantee of future results.

For illustrative purposes only.

CME crude oil futures (/CL—red and yellow lines) plotted out over the next three years show investors believe the ultimate destination is in the low-$60s per barrel. The red line charts the futures outlook from today, while the yellow line below that charts how futures were set up at the start of the year. Though prices spiked to $71 this week thanks to the war in Iran, today's chart doesn't differ appreciably in the long term from the way investors expected prices to go two months ago, before the conflict. Meaning today's high crude oil prices are seen by the market as a very temporary situation.

The week ahead

Check out the investors' calendar for a summary of the top economic events and earnings reports on tap this week.

March 4: February ADP Employment Report, February ISM Services PMI®, Fed Beige Book, and expected earnings from Broadcom (AVGO).

March 5: Fourth quarter productivity-preliminary, January factory orders, and expected earnings from Ciena (CIEN), JD.com (JD), Kroger (KR), Costco (COST), and Marvell Technology (MRVL).

March 6: February nonfarm payrolls.

March 9: Expected earnings from Oracle (ORCL), Hewlett-Packard (HPE), and Casey's General Stores (CASY).

March 10: February existing home sales and expected earnings from BioNTech (BNTX).