Will the United States Dollar Be Dethroned?

Over the years, there have been predictions that the United States dollar is on the verge of a major decline and might even lose its status as the world's major reserve currency. Recent trade conflicts have reignited this speculation. Countries facing economic pressure from tariffs, or the threat of tariffs, are discussing moving away from the dollar as the primary currency for trade. "De-dollarization," or the shift away from using the U.S. dollar as the primary currency of exchange in global trade and investment, has once again become a hot topic in financial markets.

Our view is that a long-term trend toward diversification of currencies in global financial transactions and trade may develop, but it's a big leap from dollar dominance to de-dollarization to loss of reserve currency status.

The dollar remains close to a 15-year high versus currencies of countries with which the U.S. trades. It also remains the primary currency used for trade and financial transactions in the global economy. The size of the recent non-dollar transactions that have raised concerns are very small. Trade in the Chinese yuan accounted for less than 4% of global trade as of December 2024.

There are few signs that major foreign holders are poised to suddenly shift away from U.S. dollars and there are few other currencies that could take its place as a reserve currency. In our view, a gradual move to a global economy with a less-dominant dollar is possible over time, but we don't see the dollar losing its reserve currency status.

The United States dollar boasts a decade-long bull market

There are several ways to measure changes in the level of the dollar. We generally look at indices that compare the dollar's value to the values of a broad range of currencies, weighted according to the value of their trade with the U.S.

As you can see in the chart below, during the past decade, the dollar has been propelled higher by relatively high U.S. interest rates compared to other major countries, strong capital inflows, and its status as a perceived safe haven in times of turmoil. It has risen to a new high in real terms.

The dollar's real value has risen during the past 10 years

Source: Bloomberg. U.S. Federal Reserve Trade Weighted Real Broad Dollar Index (USTRBGD Index). Monthly data as of 1/31/2025.

The U.S. Federal Reserve Trade Weighted Real Broad Dollar Index (USTRBGD Index) is a measure of the inflation-adjusted foreign exchange value of the United States dollar relative to other world currencies. Indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

The dollar's gains have been broad-based, with similar appreciation versus emerging market and major developed market currencies. This chart shows it in nominal terms.

The dollar's gains have been broad-based

Source: Federal Reserve Bank of St. Louis. Daily data as of 2/7/2025.

Nominal Broad U.S. Dollar Index, Index Jan 2006=100, Daily, Not Seasonally Adjusted and Nominal Emerging Market Economies U.S. Dollar Index, Index Jan 2006=100, Daily, Not Seasonally Adjusted. The Nominal Broad U.S. Dollar Index (Jan 2006=100, Daily, Not Seasonally Adjusted) is a measure of the nominal value of the United States dollar relative to other world currencies. The Nominal Emerging Market Economies U.S. Dollar Index (Jan 2006=100, Daily, Not Seasonally Adjusted) is a weighted average of the nominal foreign exchange value of the U.S. dollar against a subset of the broad index currencies that are emerging-market economies. Indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

Coming out of the long stretch of lackluster growth in the aftermath of the financial crisis of 2008-2009, the dollar was largely range-bound against major currencies, but it began to move higher in 2015 as U.S. interest rates moved up. Higher interest rates boosted returns to dollar-based investors. At that time, central banks in Europe and Japan were keeping policy rates at zero or in negative territory, while U.S. rates were positive. The combination of stronger economic recovery and higher yields helped push the dollar higher.

The dollar has moved higher as U.S. interest rates rose

Source: Bloomberg, daily data as of 2/11/2025.

U.S. (USGG2YR Index), Germany (GTDEM2Y Index), Italy (GTJPY2Y Index), Greece (GTGRD2Y Index), U.K. (GTGBP2Y Index), Canada (GTCAD2Y Index). Past performance is no guarantee of future results.

Demand for the United States dollar is still strong

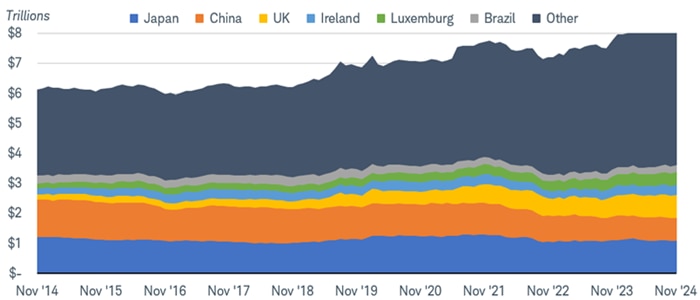

Foreign holdings of U.S. Treasury securities have grown since 2013, as you can see in the chart below.

Foreign holdings of U.S. Treasuries have expanded over the past few years

Source: Bloomberg.

U.S. Treasury securities held by foreign holders for China, Japan, UK, Ireland, Luxemburg, Brazil, and Others (HOLDCH Index, HOLDJN Index, HOLDUK Index, HOLDIR Index, HOLDLU Index, HOLDBR Index). Monthly data as of 11/30/2024. This is the most recent data available for all countries.

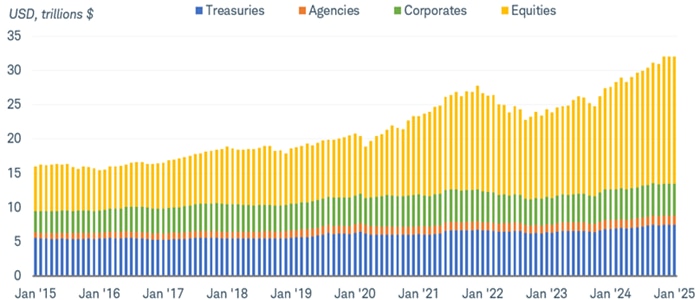

International investment flows indicate that demand for U.S. dollars extends beyond U.S. Treasury securities. With a resilient economy, the U.S. saw the largest inflow of foreign direct investment, long-term investment in businesses and property, of any major economy in 2024. It's also worth noting that much of the rise in investment flows in the U.S. over the past few years has gone into equities.

Foreign holdings of U.S. assets

Source: Bloomberg, monthly data as of 1/31/2025.

Holdings of U.S. Long-Term Securities by Foreign Residents. U.S. Treasuries (USLTTRGR Index), U.S. Agency Bonds (USLTABGR Index), U.S. Corporate and Other Bonds (USLTCBGR Index), U.S. Corporate Stocks (USLTCSGR Index).

Dollar demand for transactional purposes has remained steady over the years, as well. It still accounts for more than 80% of financial market transactions. (Foreign exchange turnover adds up to 200% because there is a currency on each side of the trade.)

Dollar's reserve currency status still holding

The dollar's position as the world's major reserve currency is periodically a source of concern among investors, even though its position hasn't changed much in decades. The dollar's share of global reserves has declined gradually over the past 20 years as central banks diversified their holdings, mostly into the euro since its introduction in 1999. Allocations of reserves to other currencies, such as the British pound and Canadian dollar, have gained modestly as well. Overall, however, the dollar still represents about 60% of global reserves, a modest decline from 67% 20 years ago.

Foreign exchange holdings by currency

Source: Bloomberg, quarterly data as of 12/31/2024.

Foreign exchange holdings as a percentage of total allocated in U.S. dollars (U.S. Dollar), the euro (Euro), the Japanese yen (Yen), the renminbi/Chinese yuan (RMB), and other reserve currencies, which are the Swiss franc, Canadian dollar, Australian dollar, British pound, and unclassified others (CCFRUSD% Index, CCFREUR% Index, CCFRJPY% Index, CCFRCNYP Index, CCFROTR% Index, CCFRCHF% Index, CCFRCADP Index, CCFRAUDP Index, CCFRGBP% Index).

There aren't currently any viable reserve-currency alternatives

A reserve currency needs to be freely convertible and have deep and liquid bond markets to be considered safe for foreign central banks to hold. Central banks need to know that their money is easily and readily available when needed, particularly in times of stress. The U.S., with a large, open, and liquid market for Treasury securities, fits that role. That's why when the COVID crisis hit the global economy, the U.S. Federal Reserve expanded its swap lines with foreign central banks to enable access to dollars for countries that were struggling to access dollars for trade and debt payments.

While other major countries' markets have these qualities, the size and openness of the U.S. market is difficult to match. Europe's bond markets are more fragmented than the U.S. market although a movement toward euro-denominated sovereign debt issuance would provide a stronger base for it as an attractive alternative. Japan's bond market is closely controlled by its central bank, which owns the bulk of its government debt. China has capital controls, and its currency isn't even freely convertible. Giving up capital controls would mean that the government would relinquish control over investment flows and leave the currency susceptible to decline if domestic investors moved their money elsewhere.

Short- and long-term views on the United States dollar

The factors supporting a strong dollar remain intact. U.S. economic growth continues to outpace the rate of growth in other major countries and wide interest rate differentials favor of the dollar. Moreover, the aggressive threat of tariffs by the United States contributes to upward pressure on the dollar as foreign currencies of countries that face tariffs typically decline to offset the impact. If trade conflicts ease later in the year, there is room for the dollar to pull back moderately from its recent high, but we wouldn't view that as the start of a long-term decline.

Longer-term, movement to a multi-currency global economy is possible and could have benefits, particularly for emerging-market countries where moves in the dollar can have big effects on economic growth. However, it would require some major structural changes in many regions—such as reducing barriers to trade and investment, along with strengthening protections for investors. These changes take time and political will.

Diversification considerations

Although we don't see a major bear market in the dollar developing soon, we do believe that investors may want to consider global diversification over the long run. Diversification works best when economic cycles diverge, which may happen later this year if U.S. economic growth slows relative to expansions in other countries. With U.S. interest rates having peaked in 2024, returns in global bond markets may improve. The current yield on the Bloomberg Global Aggregate ex-USD index is 2.6%, compared to the Bloomberg US Aggregate Bond Index yield of 4.8%. That yield gap still favors U.S. bond investments, but it is narrow enough to be offset by a modest drop in the dollar.