Weekly Trader's Outlook

Stocks Drop as Oil, VIX Surge on Iran Conflict

The Week That Was

If you read the last week's blog, you might recall that I had a "Slight to Moderate Bearish" forecast for this week, citing heightened Iran uncertainty, an elevated VIX and poor price action within the tech space. All the majors are on track to be down 1.50% or more on the week as the escalating U.S./Iran conflict, along with the corresponding rise in oil prices, loomed over Wall Street. Here are some high-level takeaways from this week:

- The U.S./Iran conflict is in its seventh day. Earlier this morning, U.S. President Donald Trump said there will be no deal with Iran to end the war without "unconditional surrender."

- WTI Crude oil prices are up over 13% today and have jumped 45% over the past month.

- On Wednesday U.S. Treasury Secretary Scott Bessent said that global tariffs will likely go from 10% to 15% sometime this week. Bessent also believes U.S. tariff rates would effectively be where they were prior to the Supreme Court ruling by August.

- Artificial intelligence (AI) disruption concerns around the software space eased up this week as the iShares Expanded Tech-Software Sector ETF (IGV + $0.13 to $87.75) is on track to be up ~7.50% on the week. On the flipside, the PHLX Semiconductor Index is on track to register its worst weekly performance (-4%) since November.

- Private credit concerns are still hovering over Wall Street. On Wednesday, Blackstone's flagship private credit fund (BCRED) was hit with record redemption requests. In response, Blackstone raised the fund's repurchase cap and provided additional capital to meet all the requests. Elsewhere, earlier today BlackRock said that it is limiting withdrawals from one of its private credit funds following a surge in redemption requests. Investors were seeking ~$1.2B in redemptions but only $620M was paid out.

- On the economic front, this morning's Nonfarm Payrolls report stands out and the report was discouraging. Employers cut 92,000 jobs in February (vs. expectations for +55,000), which represents the largest monthly drop since the pandemic.

- Q4 earnings scorecard: out of the 493 S&P 500 companies that have reported results, 65% have beat on the top line while 74% have beat on the bottom line. Revenue growth has been tracking at +9.23% year-over-year while EPS growth is +13.65%.

Outlook for Next Week

At the time of this writing (2:10 p.m. ET) stocks are lower across the board, but off the lows of the session (DJI - 515, SPX - 68, $COMP - 213, RUT - 52). Unsurprisingly, investors appear inclined to reduce long exposure ahead of the weekend given the uncertainty around Iran. WTI crude remains higher by over 12% currently and Qatar's energy minister, Saad Sherida al-Kaabi, told the Financial Times that he expects all oil and gas exporters in the Gulf to stop production within days. Earlier today, President Trump said that he will not make a deal with Iran without an "unconditional surrender." Although nobody knows how long the Iran conflict will persist, or how high oil prices will go (and for how long), it's clear that a high level of uncertainty persists. I would normally highlight next week's potential market-moving catalysts, such as the monthly inflation reports (consumer price index, or CPI, and producer price index, or PPI), and key earnings reports (ORCL, ADBE), but it seems that the Iran conflict and oil prices will override the normal course of trading. When oil prices spiked on Russia's invasion of Ukraine back in 2022, equity markets were eventually able to find stability, but it took some time. And I suspect stocks will find stability/recovery once it looks like oil prices have hit a near-term peak, likely corresponding with signs of Iran de-escalation, but we don't know when that might be. These types of exogenous events, and price shocks can be difficult (if not impossible) to predict, so I'm just providing a "Volatile" forecast for next week.

Other Potential Market-Moving Catalysts

Economic:

- Monday (Mar. 9): no reports

- Tuesday (Mar. 10): Existing Home Sales, NFIB Small Business Optimism

- Wednesday (Mar. 11): Consumer Price Index (CPI), EIA Crude Oil Inventories, Mortgage Applications Index, Treasury Budget

- Thursday (Mar. 12): Producer Price Index (PPI), Continuing Claims, EIA Natural Gas Inventories, Initial Claims, Factory Orders

- Friday (Mar. 13): PCE Prices, GDP – Second Estimate, Personal Income, Personal Spending, University of Michigan Consumer Sentiment - Preliminary

Earnings:

- Monday (Mar. 9): Annexon Inc. (ANNX), BETA Technologies Inc. (BETA), Casey's General Stores Inc. (CASY), Global Business Travel Group Inc. (GBTG), Hewlett Packard Enterprise Co. (HPE), Korn Ferry (KFY), Vail Resorts Inc. (MTN), Voyager Technologies Inc. (VOYG), ZIM Integrated Shipping Services Ltd. (ZIM)

- Tuesday (Mar. 10): AeroVironment Inc. (AVAV), BioNTech SE (BNTX), Franco-Nevada Corp. (FNV), JOYY Inc. (JOYY), Kanzhun Ltd. (BZ), Legend Biotech Corp. (LEGN), New Gold Inc. (NGD), NIO Inc. (NIO), Oracle Corp. (ORCL), Uranium Energy Corp. (UEC)

- Wednesday (Mar. 11): BBB Foods Inc. (TBBB), Campbell's Co. (CPB), Descartes Systems Group Inc. (DSGX), Driven Brands Holdings Inc. (DRVN), Guardian Pharmacy Services Inc. (GRDN), OppFi Inc. (OPFI), Netskope Inc. (NTSK), Sprinklr Inc. (CXM), UiPath Inc. (PATH)

- Thursday (Mar. 12): Adobe Inc. (ADBE), DICK's Sporting Goods Inc. (DKS), Dollar General Corp. (DG), Full Truck Alliance Co. (YMM), Futu Holdings Ltd. (FUTU), Lennar Corp. (LEN), Li Auto Inc. (LI), Ollie's Bargain Outlet Holdings Inc. (OLLI), Ulta Beauty Inc. (ULTA), Wheaton Precious Metals Corp. (WPM)

- Friday (Mar. 13): Better Home & Finance Holdings Co. (BETR), Buckle Inc. (BKE), Emerald Holdings Inc. (EEX), RLX Technologies Inc. (RLX), VEON Ltd. (VEON)

Economic Data, Rates & the Fed

There was a solid dose of economic data for markets to digest this week, highlighted by this morning's monthly jobs report. U.S. employers unexpectedly cut 92,000 jobs in February, which was one the of the largest monthly drops since the pandemic. There were also negative revisions totaling 69K to the prior two months, along with an uptick in the Unemployment Rate. The private education and health care sectors accounted for 34K of the losses, and there was a labor strike at Kaiser Permanente which likely negatively impacted the data. In case you are wondering about the potential impact from "AI disruption" within tech, Information Services shed 11,000 jobs, but honestly, it's difficult to draw a direct correlation to AI. Also noteworthy was a large downward revision in the Atlanta Fed's "nowcast" for Q1 GDP to 2.1%. On the plus side, the S&P Non-Manufacturing PMI registered the highest reading (56.1) in over three years, and weekly Initial Claims remain subdued. Here's a breakdown of the reports:

- Nonfarm Payrolls: Headline payrolls declined 92,000 in February, which was well below the +55,000 economists were expecting. There were also negative revisions to the prior two months totaling 69,000.

- Unemployment Rate: Ticked up to 4.4% from 4.3% in the prior month (and above the 4.3% economists had expected)

- Average Hourly Earnings: Increased 0.4% versus the +0.3% expected. This brings the year-over-year gain up to 3.8% from 3.7% in January and versus the +3.7% expected.

- Average Workweek: 34.3 versus 34.3 expected.

- ADP Employment Change: U.S. private employers added 63K jobs in February. This represented the largest monthly gain since last July and was above the 50K economists had expected.

- Retail Sales: Declined 0.2% in January, the largest drop since last May, and worse than the flat reading economists were expecting. However, the Control Group measure of sales rose 0.4%.

- ISM Manufacturing Index: 52.4% vs. 53.0% est.

- S&P Global U.S. Manufacturing PMI – Final: Fell to 51.6 in February from 53.4 in January and below the 52.6 economists had expected.

- ISM Non-Manufacturing Index: 56.1 highest since July of 2022.

- S&P Global U.S. Services PMI: 51.7.

- Import Prices: +0.2%.

- Export Prices: +0.6%.

- Productivity – Preliminary: +2.8% vs. +4.5% est.

- Unit Labor Costs: +2.8% vs. +0.5% est.

- Initial Jobless Claims: Initial applications for US jobless benefits were unchanged from last week at 213K, which was below the 215K economists had expected. Continuing Claims increased 35K from the prior week to a seasonally adjusted 1.868M.

- EIA Crude Oil Inventories: +3.48M barrels.

- EIA Natural Gas Inventories: -132 bcf.

- The Atlanta Fed's GDPNow "nowcast" for Q1 GDP was revised down 1.0% to 2.1% from 3.1% last Friday.

U.S. Treasury yields jumped across the board this week, and the yield curve saw some modest flattening. This week's treasury selling is essentially tied to the ramp up in oil prices and the potential inflation implications. Compared to last Friday, two-year Treasury yields rose by ~18 basis points (3.561% vs. 3.379%), 10-year yields also increased ~18 basis points (4.142% vs. 3.962%), while 30-year yields (4.777% vs. 4.633%) saw a ~14 basis point lift.

Market expectations for rate cuts from the Federal Reserve in 2026 didn't shift much this week, remaining at relatively subdued levels. Per Bloomberg, the probability of a 25-basis-point cut from the Fed in March is unchanged at 5%, April ticked up to 23% from 20%, while June currently stands at 60% from 57% (all week-over-week).

Technical Take

Russell 2000 Index (RUT - 50 to 2,534)

The Russell 2000 (RUT) is on track to be down ~3.70% on the week, hit by a one-two punch of higher oil prices and Treasury yields. Higher yields means higher borrowing costs for smaller companies and higher oil prices tend to increase input costs, hit profit margins and act as a headwind for the broader U.S. economy, so it may not be surprising to see the RUT underperform the other majors. Technically, this week's sell-off in the RUT has pulled the index below key support at the 50-day SMA (the green arrows in the chart) and it's 100-day SMA. Therefore, the near-term technical assessment is currently in the bearish camp.

Near-term technical translation: moderately bearish

Source: ThinkorSwim trading platform

Past performance is no guarantee of future results.

S&P 500 Index (SPX - 76 to 6,753)

The market-cap weighted S&P 500 index (SPX) is on track to be down ~1.80% on the week, and perhaps more technically important, the index dropped below a key support level at the 100-day Simple Moving Average (the green arrows in the chart). The index was holding within an intermediate trading range of roughly 6,800-7,000 over the past couple months but is currently below that channel as well. On a more bullish note, the "dip buyers" stepped in essentially every day this week, as evidenced by the long lower wicks on the daily candles (also called a hammer pattern), but that wasn't enough to prevent technical deterioration.

Near-term technical translation: moderately bearish

Source: ThinkorSwim trading platform

Past performance is no guarantee of future results.

Cryptocurrency News

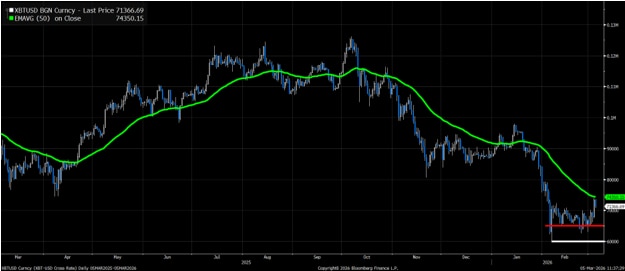

Over the weekend, bitcoin initially sold off as investors reacted to news from the Middle East. As the crypto market has matured, it has increasingly become a barometer of investor sentiment while traditional markets are closed. Throughout the week, as prediction markets began to price in higher odds of the CLARITY Act passing, bitcoin broke above $70,000. While the president and the crypto industry continue to push for passage of the bill, the banking industry does not appear to have softened its stance on stablecoin rewards. Bitcoin's rally encountered resistance near $74,000, close to the 50‑day exponential moving average (EMA).

Bitcoin may retest recent support levels after its rejection at the 50‑day EMA. The first level of support may be $65,000—its current cost of production—and potentially $60,000, its recent low. On‑chain spot activity is showing signs of improvement, with Spot ETPs posting two straight weeks of inflows and large digital‑native investors continuing to accumulate. The latest difficulty adjustment further supports the case that a bottom may be in.

Source: Bloomberg L.P.

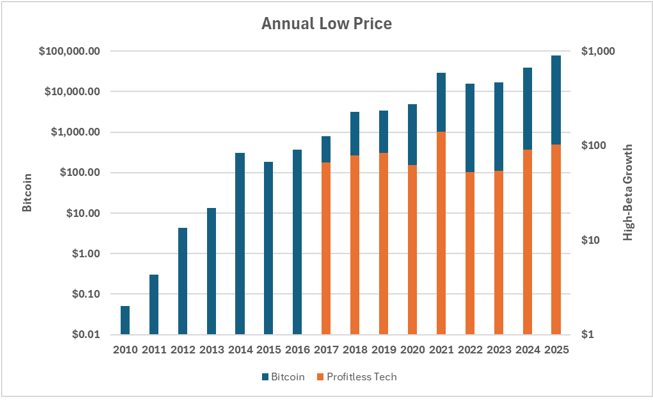

Is bitcoin a proxy for profitless tech stocks?

A common critique of bitcoin is that it simply trades in line with profitless technology stocks. While bitcoin and profitless tech share similar volatility profiles, there is a key difference between the two: profitless tech stocks have historically struggled to maintain their value.

These stocks may appear attractive based on forward estimates due to high growth expectations, but those expectations are frequently revised lower. Profitless tech stocks tend to outperform over short periods, often driven by accommodative macroeconomic conditions.

While bitcoin is also influenced by macroeconomic factors in the short term, its long‑term price has been supported by a structural supply‑and‑demand imbalance. When comparing the annual lows of bitcoin with those of profitless tech stocks, it becomes evident that bitcoin has been able to sustain its value—despite high volatility—whereas profitless tech has generally failed to do so over the long term.

The primary reason that profitless tech stocks have not maintained their value over the long term, is due to shareholder dilution from heavy stock‑based compensation. Profitless tech companies often issue equity at levels disproportionate to revenue, diluting existing shareholders as options are exercised and awards are granted. Bitcoin, by contrast, is supply‑constrained and cannot be diluted.

Source: Bloomberg LP, Schwab

Note: Profitless tech factor data is not available prior to 2017.

Market Breadth

The Bloomberg chart below shows the current percentage of members within the S&P 500 (SPX), Nasdaq Composite (CCMP), and Russell 2000 (RTY) that are trading above their respective 200-day Simple Moving Averages (SMA). In short, stocks are on track to be lower on the week and market breadth contracted as a result. Compared to last Friday's, the SPX (white line) breadth sank to 59.76% from 67.27% and the CCMP (blue line) is essentially flat at 41.68% vs. 44.75%, while the RUT moved down to 60.64% from 63.59%.

Source: Bloomberg L.P.

Market breadth attempts to capture individual stock participation within an overall index, which can help convey underlying strength or weakness of a move or trend. Typically, broader participation suggests healthy investor sentiment and supportive technicals. There are many data points to help convey market breadth, such as advancing vs. declining issues, percentage of stocks within an index that are above or below a longer-term moving average, or new highs vs. new lows.

This Week's Notable 52-week Highs (49 today): Alcoa Corp. (AA - $1.62 to $58.76), Elbit Systems Ltd. (ESLT + $5.72 to $893.82), J.B. Hunt Transport (JBHT - $5.86 to $220.50), Moderna Inc. (MRNA - $1.29 to $52.54), Ross Stores Inc. (ROST - $3.13 to $211.70), Valero Energy Corp. (VLO + $2.46 to $230.49)

This Week's Notable 52-week Lows (98 today): Apollo Global Management Inc. (APO - $3.84 to $107.40), Boston Scientific Corp. (BSX - $0.62 to $72.37), Diageo PLC (DEO - $0.11 to $82.20), Gitlab Inc. (GTLB - $0.37 to $25.00), MakeMyTrip Ltd. (MMYT - $1.26 to $51.68), The Campbell's Company (CPB + $0.03 to $25.10)