The S&P 600: An Often-Overlooked Small-Cap Index

When most people think of the U.S. stock market, the S&P 500® index and the Dow Jones Industrial Average® usually come to mind. But there's another often-overlooked benchmark that deserves attention—the S&P 600. This index focuses on smaller, domestically oriented stocks that meet specific profitability and liquidity requirements.

For investors looking for diversification opportunities or exposure to more cyclically sensitive stocks, investments that track the S&P 600 may be a useful complement within a portfolio. But it's important to recognize that small-cap stocks, like those in the S&P 600, tend to be more volatile than their large-cap peers. Investors should be aware not only of the potential benefits involved with holding small-cap indexes—but also the risks.

What is the S&P 600?

Introduced in 1994, the S&P 600 is a market-capitalization-weighted index of small-cap stocks managed by S&P Dow Jones Indices. Unlike its more widely covered peer, the Russell 2000® Index, the S&P 600 covers a relatively narrow group of stocks (600 to 602) and has additional inclusion requirements.

To be included in the S&P 600, companies must have a market cap between $1.2 billion and $8 billion, maintain a 10% public float, and have positive earnings in their most recent quarter and the past four consecutive quarters combined. They also must meet certain liquidity requirements, including having 250,000 shares or more traded in each of the past six months.

The sector composition of the S&P 600 changes over time, but the index has historically carried a higher percentage of financial, industrial, and consumer discretionary stocks and a lower percentage of information technology stocks than the S&P 500.

Benefits of investing in the S&P 600

Investing in the S&P 600 offers exposure to often under-the-radar small-cap stocks, giving investors a straightforward way to tap into growth opportunities not available in more popular large-cap indexes. Of course, it's important to be aware of the possibility that small-cap stocks might underperform large-cap stocks. Here's a look at some key reasons the S&P 600 can potentially be an addition to portfolios investors may consider.

Earnings-focused small-cap exposure

The S&P 600's earnings requirements can potentially be relevant for investors looking for exposure to profitable small caps, rather than unprofitable, debt-laden companies. As of mid-April 2025, 44% of companies in the Russell 2000 were unprofitable, compared to 20% for the S&P 600, according to Bloomberg. Those unprofitable firms aren't included in the S&P 600 because of the index's earnings requirements.

Diversification

For investors heavily exposed to large caps through major market indexes like the S&P 500, the S&P 600 can be a useful diversification tool. The small-cap stocks in the index often operate in niche industries, and their performance is at times driven by different economic factors than large caps.

Many investors in large-cap, broad-market indexes now have significant exposure to the largest U.S. tech companies. The Magnificent Seven alone accounted for nearly 35% of the S&P 500's total market capitalization in August 2025. Small-cap holdings can help diversify portfolios to prevent overexposure to large U.S. tech companies, including the Magnificent Seven.

Growth potential

Small-cap stocks typically are seen as having higher growth potential than large caps because they're earlier in their business lifecycles. This leaves more room for them to expand their revenues and market share. They can also be nimbler than larger firms, potentially making them more adaptable to new opportunities or economic shifts.

Risks of investing in the S&P 600

While there are many benefits to investing in funds that track the S&P 600, there are also significant risks. Investors should understand and be comfortable with small-cap stocks' increased volatility, vulnerability to economic downturns, and sensitivity to interest rate changes.

Liquidity

Small-cap stocks in the S&P 600 typically trade on lighter volumes and with wider bid/ask spreads, even with the liquidity requirements built into the index's selection process. As a result, trading small-cap stocks may involve buying a touch higher and selling a bit lower. That can make the funds holding these stocks potentially more volatile and less liquid and may cause small gaps between their returns and the returns of the S&P 600 index itself (called a tracking error).

Interest rate sensitivity

Small-cap stocks are generally more sensitive to interest rate changes because they have more debt, particularly short-term and floating-rate debt.

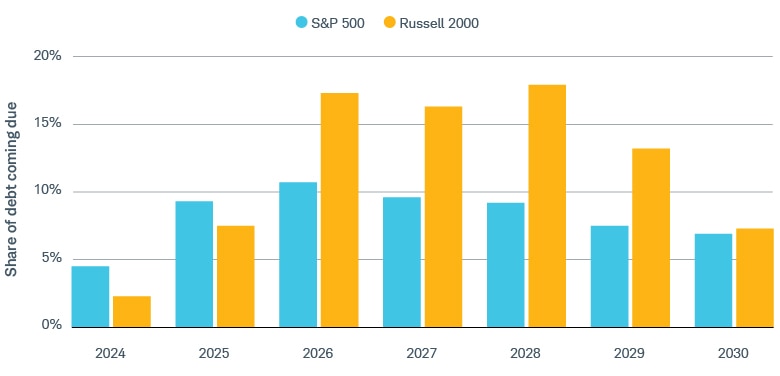

Compared to large-cap companies, U.S. small cap-companies also have a larger share of debt that will mature between 2026 and 2030, potentially exposing them to higher interest rates.

In addition to their higher debt loads, small caps often rely more on credit to finance their business operations. As a result, when interest rates rise, it can cause small caps' borrowing costs to climb substantially, squeezing profit margins.

Source: Sagarika Jaisinghani and Alexandra Semenova, "A $600 Billion Wall of Debt Looms Over Market's Riskiest Stocks," Bloomberg.com, 05/11/2024.

Forecasts contained herein are for illustrative purposes only, may be based on proprietary research, and are developed through the analysis of historical public data.

Financial instability

Small-cap companies may tend to have weaker balance sheets and lower profit margins than their large-cap cousins. This can lead to financial instability for some, particularly during periods of economic weakness.

Economic sensitivity

Small-cap stocks are typically more sensitive to the shifts in the economy for a few key reasons.

First, there are more cyclical small-cap companies that rely on strong consumer spending. When spending falls amid economic weakness, this can create problems for these firms. Second, small caps also tend to have lower profit margins and pricing power as a whole, giving them less breathing room before their businesses begin to falter when the economy is weak. Finally, as previously mentioned, higher debt levels and a reliance on credit make changes in interest rates due to economic factors more impactful for small caps' profitability.

Volatility

Small-cap stocks are typically more volatile than mid-cap and large-cap stocks because of their economic and interest rate sensitivity, have less diverse business models, and have more limited access to capital. This means investors looking to gain exposure to small caps through funds that track the S&P 600 should be willing and able to ride out turbulent times.

Private option drag

Many smaller companies may be choosing to stay private longer than they have in the past. Some professionals claim there's also a growing privatization trend among smaller public companies amid the rise of private equity. As a result, the current pool of companies in small-cap indexes may include more lower-quality businesses than it has historically. This could be one of the reasons why small caps have had lower valuations than large caps in the first half of the 2020s.

How to invest in the S&P 600

Investors have several strategies to consider after deciding to invest in the S&P 600. Each carries its own benefits and risks.

Market-cap-weighted ETFs

Many investors opt for exchange-traded funds (ETFs) to gain exposure to the S&P 600. The most common approach is to buy a market-cap-weighted S&P 600 ETF that attempts to track the returns of the whole index. In market-cap-weighted ETFs, the biggest companies have the largest representation within the fund and therefore have a greater impact on overall performance.

Style-focused ETFs

Investors can also opt for style-focused S&P 600 ETFs, which invest in baskets of S&P 600 stocks based on certain characteristics like value or growth.

S&P 600 value ETFs include stocks that are considered "cheap" according to valuation metrics like price-to-earnings, price-to-book, and price-to-sales ratios, while S&P 600 growth ETFs focus on stocks with strong sales and earnings growth.

There are also so-called blended-style S&P 600 ETFs. These include stocks within the index that have a combination of characteristics, such as high dividends and low volatility or value and momentum.

Mutual funds

Mutual funds that track the S&P 600 offer investors a non-ETF alternative. These can provide advantages for investors who want to implement automatic investment plans. There are also style-focused S&P 600 mutual funds that work similarly to their ETF counterparts.

Options and futures

Futures and options tied to the S&P 600 allow traders or investors a way to gain exposure to the index without holding ETFs or mutual funds. Traders can use these derivatives to speculate on the S&P 600's price movements or hedge portfolios. While derivatives may be of interest to traders, long-term investors may find the often short-term focus of such products to be less appealing.

While futures and options can provide flexibility and leverage, they also carry higher risks that traders should consider. Only qualified traders who understand these risks should consider these alternatives.

The S&P 600: A focused small-cap barometer

The S&P 600—with its screen that strives for a different mix of companies compared to the Russell 2000—can potentially offer investors a useful barometer of the small-cap universe. Funds that track the index may give investors exposure to the potential growth and diversification benefits of small caps, but with a tilt toward businesses that have previously generated profits—potentially making them more resilient during turbulent economic times.

Investors should ensure that the S&P 600 ETF or mutual fund they select aligns with their investment plan and long-term goals, but these more obscure funds may be worth considering, researching, or discussing with a financial advisor.