Practice Options Trading on the thinkorswim Platform

The options market is a next step for active stock traders who want to speculate on the market or generate income. But options are complicated—three times more complicated than stock trading, in fact. A stock position, long or short, may typically be successful if the trader has correctly predicted its direction (up or down). For a successful options trade, the trader also often needs to be correct about the direction as well as the degree and timing of the underlying equity's movement (or lack thereof).

With so many variables to consider, getting started with options can be intimidating. But like anything else, it's important to learn by doing and through continuous education and practice. One of the best ways to start trading options is to first learn the basic elements, and then place a practice trade (or two) via a paper-trading platform to monitor the performance in a no-risk, simulated environment.

Learning the basics

The what: Calls and puts

There are two types of options trading strategies: calls and puts. A common starting point for a new option trader is to learn about buying call options because this is a bullish strategy that is very similar to buying stock.

Buying a call at a specific strike price locks in the right to buy the associated, or underlying, security at that price, no matter how high the stock moves before expiration. Profits for the call are theoretically unlimited, while losses are capped at the premium paid for the options contract (plus transaction fees). Long calls are a defined-risk, high-upside way to leverage a stock making a bullish move. Conversely, long puts are a way to bet on a bearish move in the security.

A great way to learn options at a reasonable pace is by taking our options trading courses on thinkorswim®. It's a great way to build confidence and get hands-on experience—all without risking real money. To locate our options courses on thinkorswim desktop, go to Education > Options > Courses.

The when: Timing an options trade

A trader might choose to buy a call option when they believe a stock is going to rise in the near future, but they want to limit how much they risk. Sometimes, this decision might be based on news—like a new product launch or an earnings report—that could boost the stock.

A trader might choose to exit an options trade in a few different ways, depending on how the trade's assumptions are unfolding:

- If the stock moves in the expected direction, the trader could sell the call or put before expiration to lock in early profits.

- If the stock doesn't move as expected, the trader might sell the option well before expiration in an attempt to recover part of the premium, rather than risk losing the entire amount.

- If the option is near expiration and far from the strike price, traders may let it expire worthless, knowing the risk was limited to what they paid upfront.

- In rare circumstances—roughly 7%, according to FINRA—call buyers choose to exercise the option, activating their right to purchase shares of the underlying stock at the chosen strike price.

Getting started with paperMoney

Using the paper-trading capabilities of thinkorswim web via paperMoney®, traders can buy a call option—which is a great way to see how options work—without risking real money. Here's a simple step-by-step paper-trading guide:

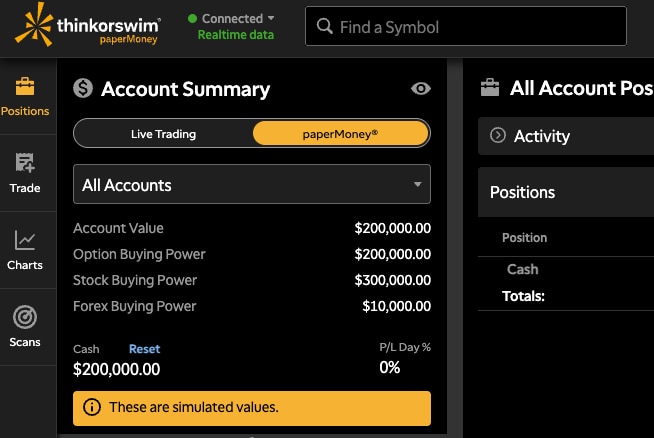

1. Open thinkorswim paperMoney feature: Launch the web version of the thinkorswim platform and log in with your credentials (make sure you've togged to paperMoney mode, not Live Trading).

Source: thinkorswim web platform

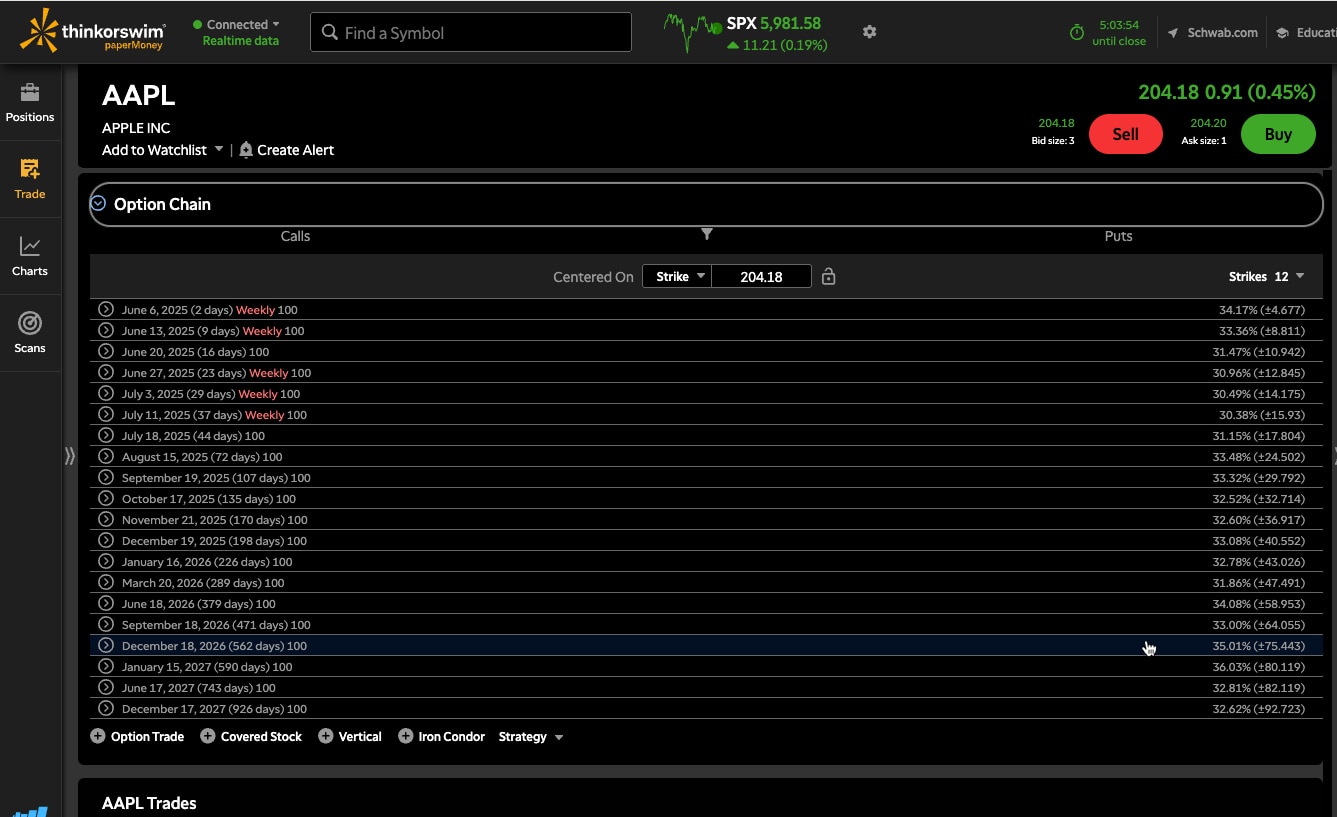

2. Go to the Trade tab: Select the Trade tab and enter the stock symbol in the box in the upper left. In this example, we'll use Apple (AAPL), a heavily traded and very liquid stock. Under the quote details is the Option Chain—select the right-facing arrow to expand this to see a list of expiration dates in the Option Chain below the symbol box—these are the dates when the options expire.

Source: thinkorswim web platform

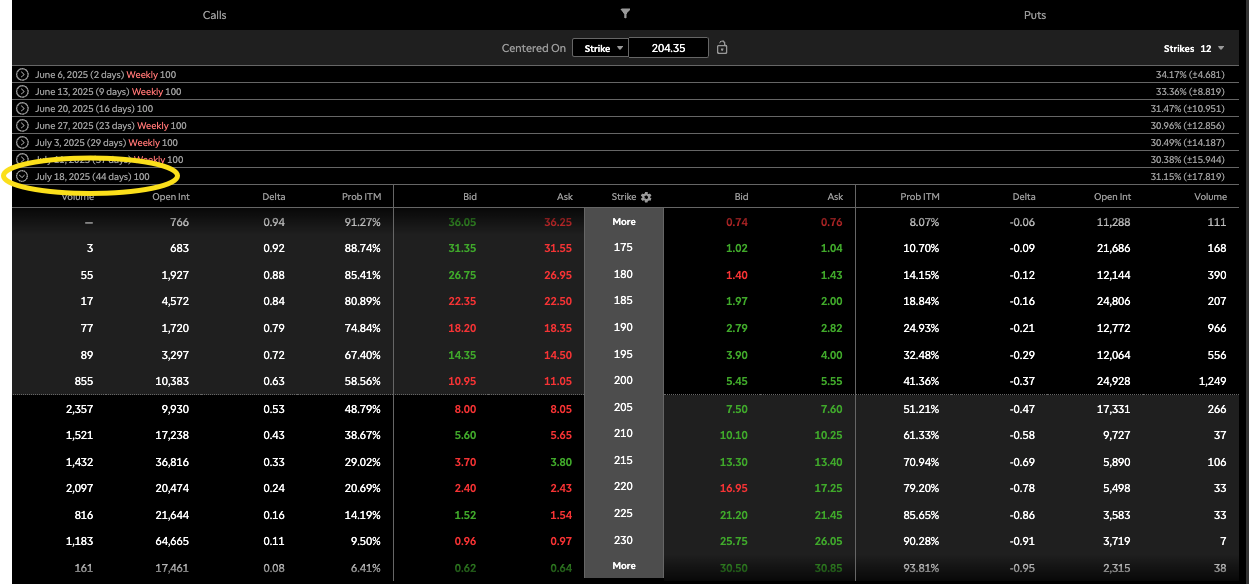

3. Select an expiration date: Select the arrow next to a date to expand the list of available options for that expiration.

Source: thinkorswim web platform

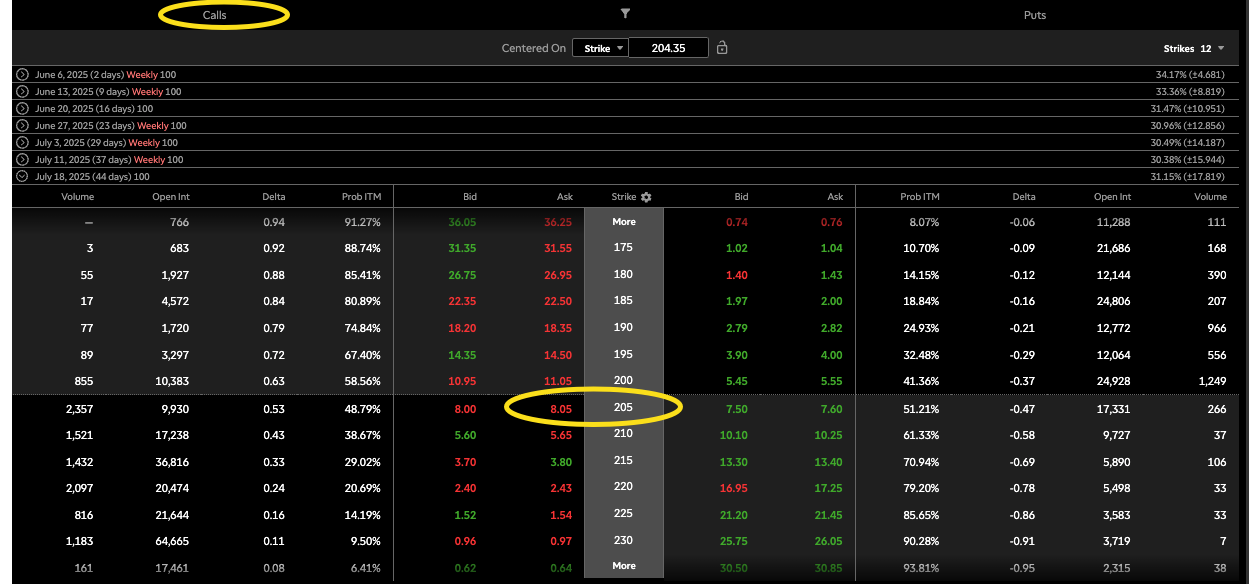

4. Choose a strike price: To purchase a long call—which will benefit from a rise in stock—look under the Calls section on the left and select a strike price from the Strike column. For beginners, it's common to choose a strike that's just above the current stock price (slightly out of the money). In the example below, that would be the 205 strike.

Source: thinkorswim web platform

5. Buy the call: Select the Ask price for the selected strike. This will open an Order Entry window at the bottom.

6. Review the order: Double-check the details (quantity should be 1 contract = 100 shares). Leave the order as Limit if a maximum allowable purchase price is preferred or change to Market if the priority is to have a stronger probability of a rapid fill.

Source: thinkorswim web platform

7. Send the order: Select Review, then Send to place the trade.

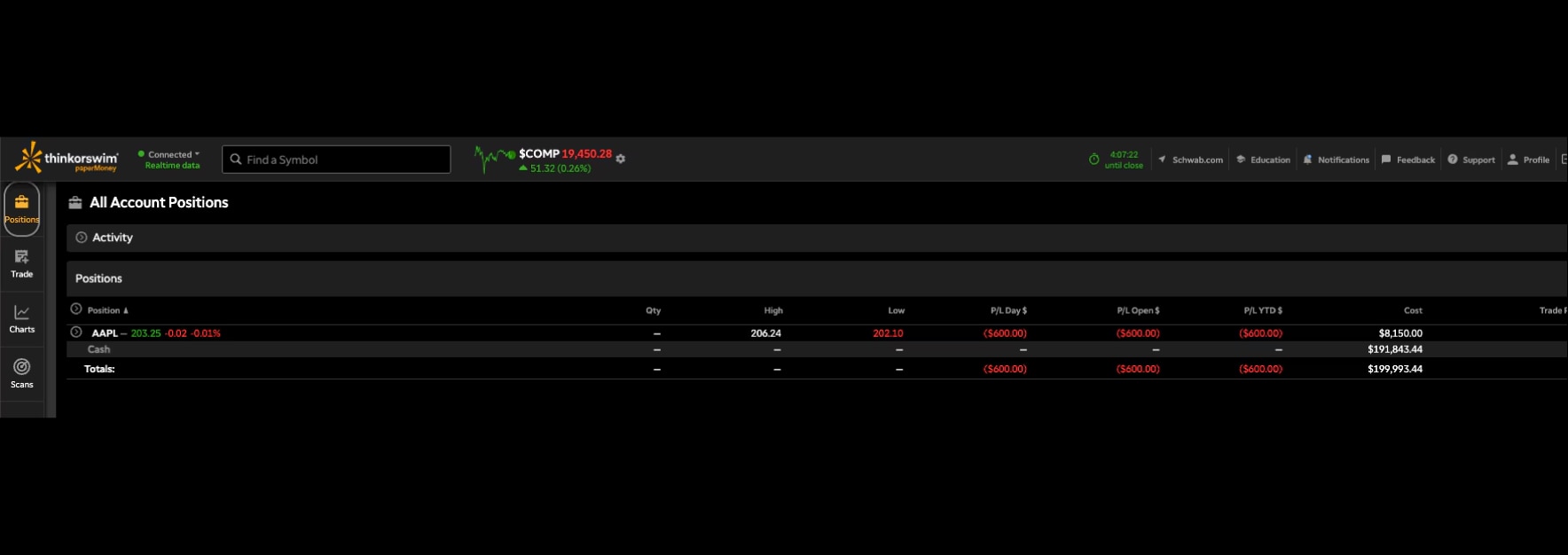

8. Monitor the trade: Go to the Positions tab to track open positions, see how the option reacts to changes in the stock, and review unrealized gains or losses. From here, traders can eventually decide when and whether to sell, let the option expire, or exercise the call by taking ownership of the 100 shares (spending about $20,500 paper dollars to do so).

Along the way, keep an eye on the changing values of the P/L Open field. This tells traders how much they have profited or lost since the trade was initiated. Some traders may choose to take profits on a cooperative trade if, for example, the profit in this field matches the initial cost of the trade, or in other words, if the call has doubled in value. On the other hand, if the stock is struggling and the call is losing value, some traders will choose to exit if their P/L Open shows a loss of half the cost of the call.

In any event, be aware that if the stock price is above the call's strike price and the contract reaches expiration, the call will automatically be exercised—whether the call buyer intends it or not—and the shares will be purchased on their behalf. For this reason, keep an eye on the column titled Days, which is a reminder of how much time is left before expiration.

As profits and losses are managed over time, patterns may emerge in trade decisions that have enhanced—or hindered—the portfolio's performance. For example, some traders may excel in selecting the right time to buy a call but may have been too quick to exit, leaving potential gains on the table.

Others may observe that they tended to hold losing contracts for too long, surrendering profits or extending losses that might have been otherwise minimized. Whatever the case, consistent paperMoney practice and a targeted education plan may help a trader accelerate along their personal learning curve.

Source: thinkorswim web platform

Lessons offered by practical experience don't have to be expensive. Because thinkorswim paperMoney feature offers a no-risk playing field, traders can experiment with different expiration dates, strike prices, and underlying stocks—both puts and calls—until their feet are sufficiently wet.

Continuing your options education

As part of leveling up your trading game, Schwab Coaching offers direct access to education coaches that can help you as you build confidence and expand your trading skills through a library of Schwab Coaching webcasts on YouTube.

Welcome to the world of options. Best of luck as you pursue this new frontier of trading.

Another great starting point for beginners is the Getting Started with Options webcast. Attend live every Tuesday at noon ET via our YouTube channel or watch them on demand.