Looking to the Futures

Nat Gas Looks for Support

Natural gas prices surged yesterday as geopolitical tensions in the Middle East could disrupt LNG shipments. BNEF data shows an increase in natural gas production and demand increased year-over-year. Above average temperatures in the lower-48 could reduce natural gas heating demand. US Electricity output is down from the same time last year and the weekly EIA report was bearish for natural gas prices.

Natural gas prices traded higher on Monday on the coattails of crude oil prices. The escalation of conflict in Iran has increased fears of shipment disruptions of liquified natural gas in the region.

Data released by BNEF last Friday shows lower-48 dry gas production in the US increased +6.3% y/y to 113.6 bcf/day. Gas demand in the lower-48 also increased to 86.0 bcf/day, up +5.9% y/y. The BNEF released estimated LNG net flows to US LNG export terminals were up +1.5% w/w to 19.9 bcf/day. The EIA raised its forecast for 2026 US dry natural gas production to 109.97 bcf/day, increasing last month’s estimates of 108.82 bcf/day. US nat gas production is currently near record highs.

Above average temperatures have limited heating demand for natural gas. Last Friday, the Commodity Weather Group announced above-average temperatures are expected in the eastern half of the US from March 4-13. This is following a significant spike in prices in late January after a massive storm caused a sharp increase in heating demand. The Arctic temperatures caused freeze-ups in gas wells and disrupted production across Texas. Nearly 50 billion cubic feet of natural gas went offline, accounting for 15% of total US natural gas production.

Reports from the Edison Electric Institute last Wednesday showed US electricity output dropped 13.46% y/y to 78,464 GWh in the week ending February 21st. US electricity output in the 52-week period ending February 21st increased +1.7% y/y to 4,302,222 GWh.

Last week's EIA report was bearish for natural gas prices with inventories dropping -52 bcf in the week ending February 20th. This was slightly lower than the expected -50 bcf draw and well below the 5-year weekly average draw of -168 bcf. Natural gas inventories were up +9.7% y/y and -0.3% below the 5-year seasonal average.

On Friday, Baker Hughes reported the number of active US nat gas drilling rigs increased by +1 to 134 rigs in the week ending February 27th.

Technicals

Looking at the daily chart for Natural Gas April 2026 (/NGJ26) futures contract we can see the attempt to find support following the significant rally and pullback in late January. The contract has been trading well below the 50-Day and 200-day Simple Moving Averages and was unable to break the 20-Day SMA price point during yesterday’s session.

The Daily Technical Summary from Hightower Research has support levels at 2.820 and 2.781 with resistance levels at 2.896 and 2.933. Both resistance levels were broken during yesterday’s trading.

According to the CFTC Commitment of Traders report released February 24th managed money traders have decreased their long position by -8,712 contracts and increased their short position by +40,398 contracts. Asset managers were net short -75,875 contracts as of the time this report was published.

The 14-Day Relative Strength Index at 45.31% indicates slightly more sellers than buyers.

20-Day SMA 3.032

50-Day SMA 3.128

200-Day SMA 3.533

14-Day RSI 45.31%

Implied Volatility 51.93%

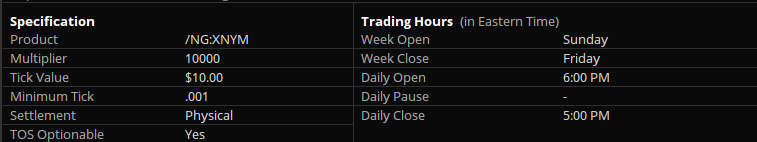

Contract Specifications

Economic Calendar

FOMC Member Williams Speaks 9:55 am est

FOMC Member Kashkari Speaks 11:45 am est

API Weekly Statistical Bulletin 4:30 pm est

New Products

New futures products are available to trade with a futures-approved account on all thinkorswim platforms:

- Ripple (/XRP)

- Micro Ripple (/MXP)

- 100 OZ Silver (/SIC)

- 1 OZ Gold (/1OZ)

- Solana (/SOL)

- Micro Solana (/MSL)

Visit the Schwab.com Futures Markets page to explore the wide variety of futures contracts available for trading through Charles Schwab Futures and Forex LLC.