Weekly Options: Uses, Risks, and Trade-offs

Before 2005, stock options expired just once a month, typically on the third Friday of each month. Today, the expiration landscape is far more diverse, particularly for traders focused on short-term moves or trading around specific events like earnings and data releases.

While traditional third-Friday weekly options are still widely traded, exchanges now offer weekly expirations on hundreds of exchange-traded funds (ETFs), indexes, and stocks. Some actively traded indexes and mega-cap stocks have even more frequent listings. For example, Apple (AAPL) has options that expire every Monday, Wednesday, and Friday.

Once a niche product, weekly options have grown rapidly in popularity over the last decade. According to the Options Clearing Corporation, contracts with weekly expirations now account for roughly 60% of total options trading volume.

Because of their shorter time to expiration, weekly options are often used to gain more timely exposure to events. More advanced traders may also use them to implement short-term hedges or target brief but sharp volatility shifts.

Weekly vs. monthly options

Although weekly options have shorter lifespans in total, an option with just a few days until expiration carries the same inherent risks whether it's labeled a weekly or serial (traditional monthly) option.

All options contracts—regardless of when they expire—are structurally identical, with each standard contract representing 100 shares of the underlying stock or other security. And with American-style options, a trader can exercise a long option or be assigned a short option at any time on or before expiration, regardless of how soon that expiration occurs.

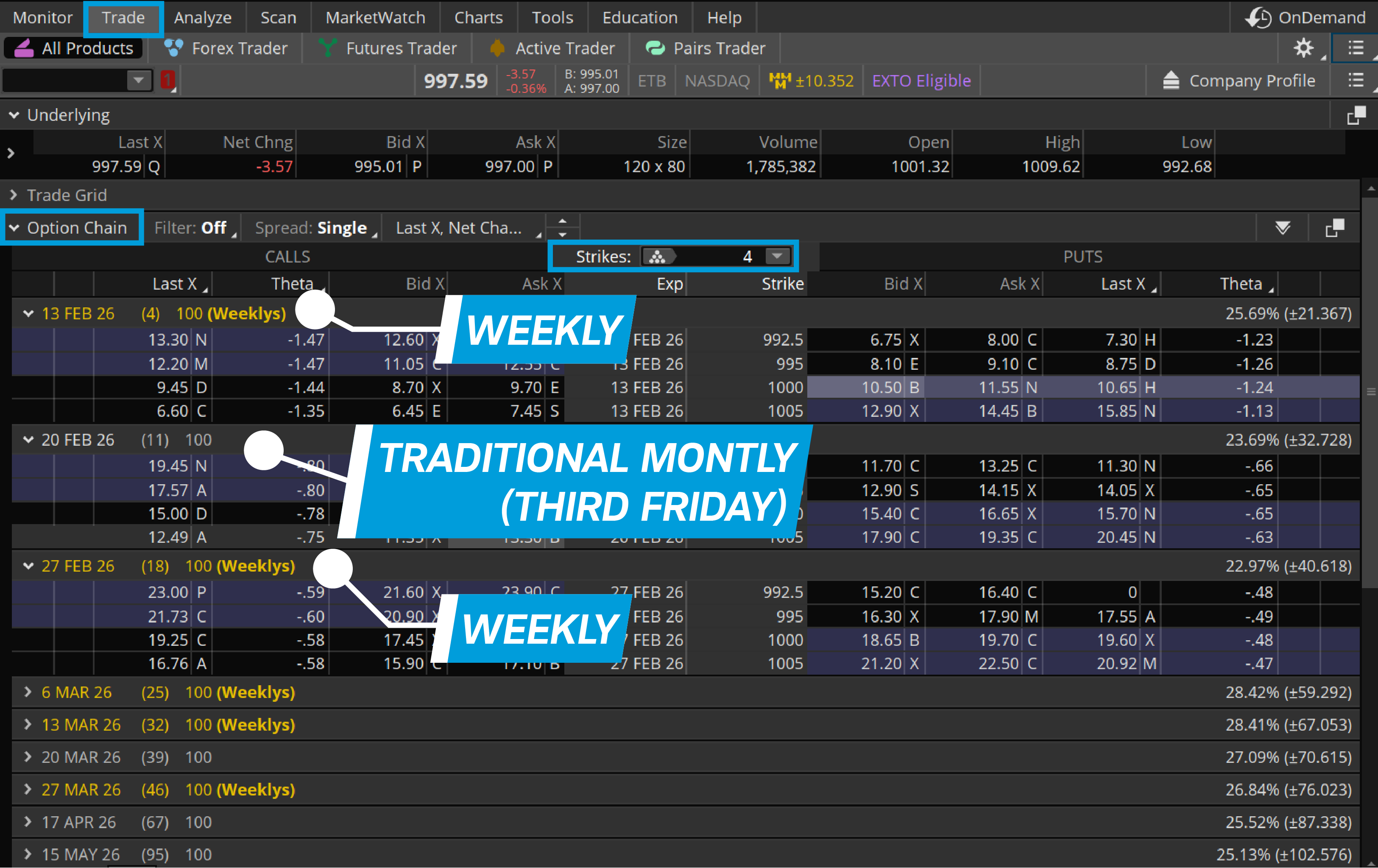

Option traders can view all available expirations and strike prices on a stock offering options using the thinkorswim® platform. From the Trade tab, scroll down to Option Chain and expand by selecting the right arrow. Weekly options are designated in yellow. To see additional strike prices, select the desired number from the Strikes drop-down menu located between the call and put sections.

Source: thinkorswim platform

For illustrative purposes only.

Characteristics of weekly options

Although weekly options do not differ from monthly options in terms of contract structure, their shorter time to expiration can lead to several distinct trading characteristics:

- Potentially lower premiums. Shorter‑dated options typically cost less than longer‑dated contracts, giving traders the flexibility to target near‑term outcomes without paying for weeks of additional time value. For option sellers, however, this also means premiums collected may be smaller.

- Faster rate of time decay. Time decay, or theta, accelerates as expiration approaches. Traders selling weekly options closer to expiration may benefit from this, while option buyers need to be mindful of rapid developments in their positions.

- Greater sensitivity to price changes. Short-term, at-the-money options tend to have higher gamma, which means their delta can change more rapidly with moves in the underlying stock. This relationship can lead to sharper swings in the value of the option during volatile periods or around market-moving events.

Weekly options strategies

Traders seeking targeted exposure to short-term market events can leverage weekly options in a variety of options strategies to express short-term directional views, volatility expectations, or time-decay-focused strategies. term directional views, volatility expectations, or time-decay-focused strategies.

Targeting lower premium and higher gamma

A trader who expects an outsized move on an earnings report or other announcement could consider buying a call or put option. Due to their shorter time until expiration, they typically carry lower premiums than longer-dated options. The risk of buying a call or put is limited to the premium paid for the option (in addition to transaction fees).

A trader who expects a significant move but isn't certain of the direction could consider a straddle or strangle using weekly options. These volatility-based strategies are designed to benefit from large price movements in either direction, provided the move occurs in the limited time before expiration. The maximum loss for a long straddle or strangle is the combined premiums paid for the call and put (plus any commissions or fees).

Targeting higher theta

On the flip side, traders who think the market expects too much of a move heading into an event could consider strategies that take advantage of time decay like selling options or trading options spreads.

One example of an options spread is an iron condor. This strategy combines a short vertical call and a short vertical put, and the theoretical max loss is the difference in strike prices minus the premium received. By using weekly options, the faster rate of time decay can work in the seller's favor, provided the underlying stock remains relatively stable until expiration.

Targeting expiration frequency

Some traders use covered calls as an income-generating strategy against stocks they already own. In these cases, weekly options may be appealing because they allow traders to take advantage of short-term time decay on a recurring basis.

Although the premium received from selling a weekly covered call is typically lower than that of a monthly option, the strategy can be repeated week after week, provided the trader is comfortable letting go of their stock position in the case of assignment.

Potential risks of weekly options

Before trading weekly options, it's important to understand the risks associated with their shorter lifespan.

Because weekly options have less time until expiration, small movements in the underlying stock can have an outsized impact on options prices. This added sensitivity—especially around events—can quickly turn gains into losses.

As a result, weekly options require closer monitoring. Traders may find themselves spending more time managing their positions without necessarily improving their trading results.

Transaction costs are another factor to consider. Trading more frequently, as is often the case with these shorter-term contracts, can result in additional transaction costs that lower overall returns.

As with any options strategy, traders should weigh the potential drawbacks carefully to determine whether weekly options align with their broader portfolio goals and risk tolerance.

Bottom line

Weekly options are neither better nor worse than monthly options—they're simply different. Their shorter lifespan can make them useful tools for targeting specific events, managing risk, or expressing short‑term market views—but that same speed amplifies both opportunity and risk. As with all options strategies, understanding how weekly options behave, how their costs potentially add up, and how much attention they require can help traders decide whether they belong in their broader trading plan.