Jigsaw Puzzle: Growth vs. Value

The growth vs. value debate can get heated at times, but the discussions are often without appropriate context (and/or construction details). There are eight commonly followed growth and value indexes among those constructed by Russell and S&P Dow Jones:

- Russell 1000 Growth (large cap growth, some overlap into value)

- Russell 2000 Growth (small cap growth, some overlap into value)

- Russell 1000 Value (large cap value, some overlap into growth)

- Russell 2000 Value (small cap value, some overlap into growth)

- S&P 500 Pure Growth (strict growth-only, no overlap into value)

- S&P 500 Growth (traditional growth, overlap into S&P Value allowed)

- S&P 500 Pure Value (strict value-only, no overlap into growth)

- S&P 500 Value (traditional value, overlap into S&P Growth allowed)

In terms of construction, Russell uses a probability-based model, with stocks receiving growth and value scores, and can have partial exposure to both styles. Russell's growth indexes are more forward-looking, using analyst forecasts rather than historical momentum like S&P. Russell's value indexes place more emphasis on dividend yield, unlike S&P, which focuses more on price/book and price/earnings ratios.

Performance implications

The somewhat-recent pullback in "growth" sectors' performance (somewhat at the expense of their "value" counterparts) has not been even across the board—both at the index level and down the cap spectrum. Before digging into performance details, it's worth emphasizing the three ways investors typically think about growth and value:

- There are growth- and value-labeled indexes like those from S&P and Russell detailed above.

- There are pre-conceived notions of growth and value stocks.

- There are the factors, or characteristics, of growth and value.

As an example, the Technology sector is often thought of as a growth sector, while Financials is often thought of as a value sector. For the most part, those parings make sense, but there are times when they aren't reflected in the indexes. A recent instance of this was at the end of 2022, when S&P rebalanced its Growth and Value indexes rather dramatically.

December 2022 case study

In mid-December 2022, after the conclusion of that year's bear market, S&P took six of the "Magnificent 7" (Mag7) names (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla) out of the S&P 500 Pure Growth Index, with only Apple remaining for the following year. That's notable given S&P's Pure indexes are meant to reflect, well, the purest growth or value characteristics (hence the no overlap policy within the Pure indexes).

Given the mega caps' strong rebound in 2023, "growth" did well relative to "value" that year, but it wasn't equally distributed among the indexes. As shown via the green line in the chart below, S&P 500 Pure Growth barely made any headway relative to S&P 500 Pure Value; the real strength was in Russell 1000 Growth relative to Russell 1000 Value (and that is still the case today). Russell 1000 Growth's relatively sharp rebound kicked in right at the start of 2023, leaving S&P 500 Pure Growth's relative performance in the dust. That was almost entirely attributed to S&P's leaving out the aforementioned six Mag7 members; as well as the relatively mild rebalancing of the Russell indexes in the middle of 2023.

Growth dominance not equal

Source: Charles Schwab, Bloomberg.

Data is from 1/3/2022 to 2/14/2025 and is indexed to 100 at 12/31/2022. An index number is a figure reflecting price or quantity compared with a base value. The base value always has an index number of 100. The index number is then expressed as 100 times the ratio to the base value. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results. For illustrative purposes only.

That "issue" hasn't necessarily been rectified today, given the list of top 10 constituents (by index weight) in S&P 500 Pure Growth doesn't include a single Mag7 stock. In fact, in the top 10, there are three Industrials stocks, one Utilities stock, and one Energy stock. Even more interesting: there is only one Technology stock (Arista Networks) in the top 10.

There are a couple of interesting take-aways when looking at year-to-date (through Friday's close) price performance among these eight indexes, shown below. To say growth is outperforming is somewhat accurate given the top ranking of S&P 500 Pure Growth. However, the performance readings for S&P 500 Growth and Russell 1000 Value are nearly identical; while Russell 2000 Growth is closer to the bottom of the ranking.

- S&P 500 Pure Growth: +8.0%

- S&P 500 Growth: +5.0%

- Russell 1000 Value: +4.9%

- Russell 1000 Growth: +3.7%

- S&P 500 Value: +2.8%

- Russell 2000 Growth: +2.6%

- S&P 500 Pure Value: +2.2%

- Russell 2000 Value: +1.9%

Source: Charles Schwab, Bloomberg. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

More on sector dispersion

Shown below is a style index version of our quilt charts, which typically show performance among asset classes or sectors, ranked over time. This time, each percentage represents the weight of each sector (using the standard S&P GICS sector classifications) in the index listed at the top.

Variation in sector weightings

Source: Charles Schwab, Bloomberg, as of 1/31/2025.

Sector weight is comprised of the following 11 Global Industry Classification Standard (GICS®) sectors: Consumer Discretionary Sector, Consumer Staples Sector, Energy Sector, Financials Sector, Health Care Sector, Industrials Sector, Information Technology Sector, Materials Sector, Real Estate Sector, Communication Services Sector, and Utilities Sector. Numbers may not add up to 100% due to rounding. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. For illustrative purposes only.

Using the Technology sector again as an example, notice the high weighting among the four growth indexes, which probably isn't a surprise. However, Technology is also the largest sector within the S&P 500 Value index. In fact, at nearly 24%, Technology is weightier in that value index more than it is in either the S&P 500 Pure Growth or Russell 2000 Growth indexes. Another example is the Industrials sector, which has the highest weight in two of the growth indexes, but also the second-highest weight in two of the value indexes. On the other hand, Communication Services is often considered a growth sector, yet its weight within the growth indexes is all over the map.

It's in the numbers

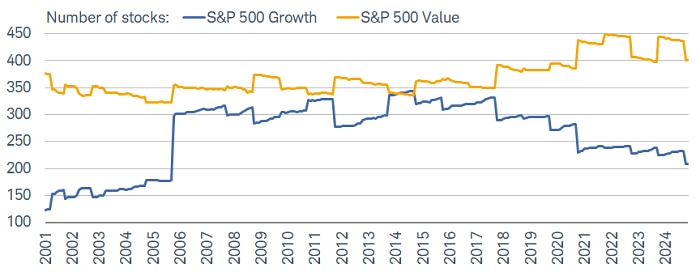

One can also look at shifts in the growth and value landscape over time by comparing how many stocks are in the indexes with how many actually exhibit growth and value factors. As shown below, the number of stocks in the S&P 500 Growth index has steadily declined from a peak about a decade ago, but still remains high relative to the inception of the index in 2001. Conversely, the number of stocks in the S&P 500 Value index, while off its peak, is still fairly high relative to history.

More value than growth

Source: Charles Schwab, Bloomberg. Data is from 3/31/2001 to 1/31/2025.

For illustrative purposes only. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly.

The story changes when screening for the number of stocks that have true characteristics of growth and value. This is by no means an exhaustive screen, as there are many ways to characterize and define each style, but for now we'll stick with simple definitions for each (shown in the footnote of the chart below). Within the overall S&P 500 index, the number of stocks with a defined value factor has declined more dramatically, especially since the peak associated with the global financial crisis. Those with a defined growth factor has been a bit steadier, though down from the peak during the dot com bust. This emphasizes the importance of taking a factor-based approach when it comes to growth and value. There are times (like today) when huge differences in indexes and factors can lead to dramatically different performance dynamics.

Less value in S&P 500

Source: Charles Schwab, Bloomberg. Data is from 1/31/1993 to 1/31/2025.

Growth stocks are defined as those with 5-year average sales growth above 15%. Value stocks are defined as those with a price-to-sales ratio below 1. For illustrative purposes only. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly.

In sum

Pre-conceived notions of "growth" and "value" aren't always reflected in indexes labeled growth and value. That has been both exacerbated and emphasized in the post-pandemic era, especially for a sector like Technology, which is traditionally thought of as dominating the growth sphere but now has a hefty weight in some Value indexes (e.g., S&P 500 Value). These details matter at a time when sector leadership shifts remain rampant and swift—particularly when the sectors in question (i.e., Technology) constitute such a large portion of the market. This matters for investors who tend to take a more passive approach and track indexes, as changes in index construction have led to discrepancies between conventional wisdom and actual reality.