Energy: Global Excess or Shortage of Power?

Recent conflict in the Middle East had raised concerns about higher energy prices, but crude oil prices reversed course amid a ceasefire and excess supply. Longer term, there could be an energy shortage due to electricity demand from artificial intelligence (AI) if more actions are not taken. Data center power needs could create both investment opportunities and risks.

Israel-Iran war: Market reaction muted so far

The Israel-Iran conflict revived concerns of potential disruption to oil supply through the Strait of Hormuz, a chokepoint through which roughly 20% of global oil and gas passes daily. Nuclear infrastructure has been the primary target for attacks thus far; energy supply targets have been largely spared. The modest 1.1% decline from a record high in the MSCI World Index on June 13th may have demonstrated a belief that the upside oil price risk was likely short-term in nature. Markets likely looked at the effects of past geopolitical events. Historically, these events rarely have had more than a short-term impact on the price of oil as seen in the table. Oil prices have only been higher three months later 36% of the time, and by 0.6% on average. These exceptions were during periods when supply of oil became significantly disrupted for a sustained period. Despite calls for a ceasefire, negotiations could still fall apart and reignite concern, but the supply/demand balance of oil may keep market concerns contained.

Geopolitical events typically have had a short-term impact on markets

| 3 mos. prior | 1 mo. prior | 1 day after | 5 days after | 1 mo. after | 3 mos. after | |

|---|---|---|---|---|---|---|

| MSCI World Index | 1.1% | 0.8% | -0.2% | 0.2% | 0.7% | 1.9% |

| ICE Brent Crude Futures | 4.2% | 2.0% | 0.8% | 0.7% | -0.3% | -0.6% |

Near term: Supply of oil exceeds demand

Another reason for a relatively muted market reaction to the Israel-Iran war is likely the supply/demand balance of oil. The International Energy Agency (IEA) states that unless a major disruption occurs, oil markets in 2025 will be well supplied. The world has excess spare oil production—exemplified by OPEC+ cutting output relative to its ability to produce. After five years of production restraint and voluntary supply cuts of 2.2 million barrels per day since 2023, at its March 2025 meeting, OPEC+ started adding back production in April. OPEC+ could hike output again at its July 9-10 meeting, for the fifth straight time. In the near term, U.S. producers could accelerate output and still make a profit even if prices fall from here, if they were fortunate enough to use hedges to lock in higher prices during the spike that occurred during the Israel-Iran conflict.

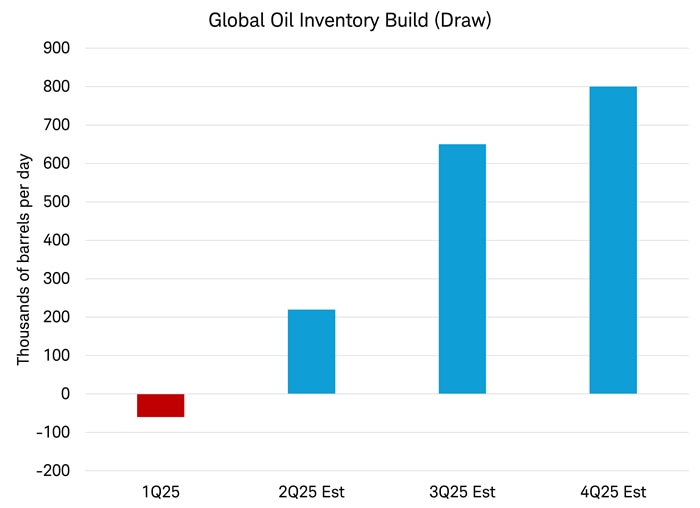

On the demand side, summer tends to be a time of peak oil usage. This year, global growth is expected to slow relative to 2024. Slower growth tends to bring less demand for energy. Inventories of oil are predicted to rise in coming months according to Bloomberg Intelligence, putting downward pressure on prices.

Oil inventory is expected to rise in coming months

Source: Bloomberg Intelligence, OPEC, Energy Information Administration, International Energy Agency (IEA), BP, as of 6/24/2025.

Second, third and fourth quarters are estimates Forecasts contained herein are for illustrative purposes only, may be based upon proprietary research and are developed through analysis of historical public data.

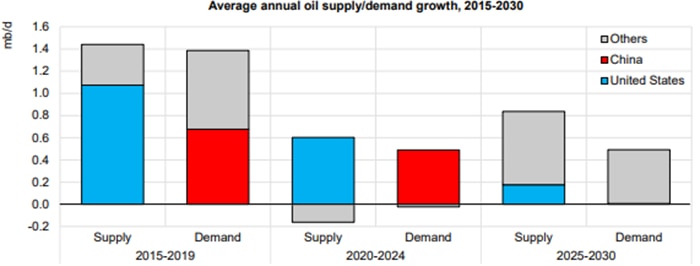

Longer term: Oil supply expected to exceed demand

Taking a multi-year outlook, oil markets are undergoing a transformation due to changes in supply-and-demand trends. Most notably, China is expected to go from 60% of the global increase in oil consumption during 2015-2024 to virtually no increase in demand from 2025-2030, according to the June forecast by the IEA. The change in China's demand reflects the adoption of low-cost electric vehicles (EVs), deployment of trucks using liquified natural gas (LNG) and other factors. Other notable dynamics include India, whose growth is far outpacing oil demand growth in any other country, while Saudi Arabia is accelerating its shift away from using oil in power generation. On the supply side, the IEA forecasts the U.S. and Saudi Arabia to provide the largest growth in oil production, led by LNG increases, despite an anticipated decline in U.S. shale production.

U.S. and China's shares in global oil supply and demand growth have faded

Source: IEA, as of 06/17/2025.

Mb/d = million barrels per day. Data for 2025-2030 is estimated. IEA 2025; "Oil 2025" [https://www.iea.org/reports/oil-2025], License: CC BY 4.0. Forecasts contained herein are for illustrative purposes only, may be based upon proprietary research and are developed through analysis of historical public data.

Artificial intelligence is transforming the energy sector

Investment and adoption of artificial intelligence (AI) has increased demand for electricity by data centers. As a result, electricity demand globally is shifting from years of flat or declining use, to a forecasted multi-year period of growth, according to the IEA's April 2025 Energy and AI Report. The report projects that global data center demand for electricity may more than double by 2030 and could account for half of new power demand this decade in advanced economies. In emerging market countries in aggregate, data centers represent only 5% of the electricity demand increase—overall economic growth is a bigger factor. In 2024, the U.S. accounted for the largest share of data center electricity consumption, at 45%, followed by China (25%) and Europe (15%), according to the IEA.

Where will the supply of this electricity come from? Electricity is fueled using natural gas, coal, nuclear and renewables such as wind, solar, water and biofuels. The IEA believes that half of the data center demand will be met by renewables, supplemented by natural gas, nuclear and geothermal technologies. Additionally, infrastructure investment will be needed: transmission and distribution systems, generation equipment, energy storage solutions, regulators and electrical connectors. Electricity grids are already strained in many geographies—the power crisis in Texas in 2021 and in Spain in April 2025 have fueled calls for upgrades or replacement of aging equipment.

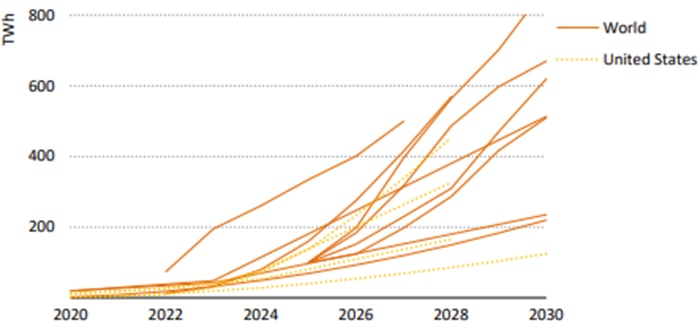

Large uncertainties about the path forward for AI and demand center electricity demand abound, as seen in the varied estimates in the chart below. These include: the pace of AI adoption; power, cooling and technological improvements; fuel supply; manufacturing, material and funding constraints; and regulatory/policy. The efficiencies embedded in China's DeepSeek AI model, launched in January, spurred a wave of new AI projects and greater electricity demand rather than reducing overall power consumption. DeepSeek's introduction and the initial concerns it engendered illustrate that AI development is still in flux and can create market volatility from time to time.

Data center electricity demand estimates vary

Source: IEA Analysis based on data from Deloitte (2024), Gartner (2024), Goldman Sachs (2024), Schneider Electric (2024), SemiAnalysis (2024) and Shehabi, et al. (2024).

Forecasts contained herein are for illustrative purposes only, may be based upon proprietary research and are developed through analysis of historical public data

TWh stands for terawatt-hour, a unit of energy. For illustrative purpose(s) only. IEA 2025; "Energy and AI" [https://www.iea.org/reports/energy-and-ai], License: CC BY 4.0.

Investment implications

In the near term, absent a geopolitical flare-up that disrupts oil supply, the prospect for lower oil prices could be good news for stock markets due to the impact on economic growth. Cheaper energy prices can lower costs for businesses, reduce inflation, and give consumers more money to spend. However the boost to growth may be lower than in the past, as the relationship between economic growth and oil demand in advanced economies has diminished over the past several decades due to a higher percentage of growth coming from services versus manufacturing, fuel efficiencies, teleworking and substitution in transport.

Longer term, increased demand by data centers to power AI is likely to transform the energy sector. Simply put, there is no AI without energy. Utilities and independent power producers who can add capacity, as well as manufacturers of the equipment to power electricity, could experience accelerated revenue growth. Fuel for electricity, in particular natural gas in the near-to-intermediate term, could see increased demand and higher prices after years of underinvestment. Nuclear could provide a reliable clean fuel source longer term, but faces high costs, complex regulatory processes, hesitation by the public and under-developed supply chains, which could slow progress. If electricity supply is unable to keep up with demand, service disruptions could occur, industries that are energy-intensive could see profit margins hit via higher costs and consumers could face inflation via higher electricity bills. Companies that provide the infrastructure to power AI could experience new investment opportunities and a multi-year period of growth. However, there is the risk that AI electricity demand forecasts and ability to meet that demand may not meet the high expectations that stocks in these industries may be currently pricing in.

Heather O'Leary, Senior Global Investment Research Analyst, contributed to this report.