AI: Stairway to Heaven or Heartbreaker?

Artificial intelligence (AI) has rapidly moved from the domain of science fiction into a real economic and financial force. Investors are grappling with how transformative this technology will be, how widely it will diffuse, and what that means for companies, industries, and markets. While most of the bulls’ case rests on AI ushering in a new era of productivity, innovation, and wealth creation, the bears’ case typically emphasizes hype cycles, misallocation of capital, regulation, and the limits of current technology/data centers/power.

What say you, bulls?

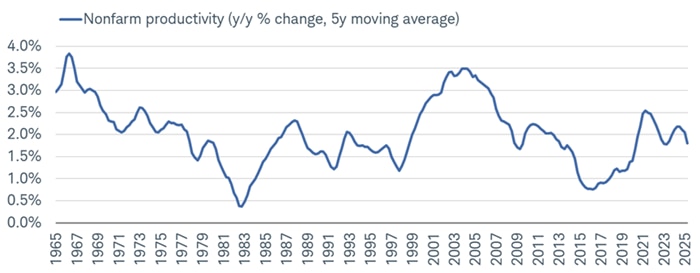

The most powerful argument for AI is its potential to boost productivity across the economy. Generative AI can automate tasks in everything from writing, customer service, marketing, coding, logistics, drug discovery, and beyond. Just as electrification and the internet created general-purpose platforms that lifted output and lowered costs, AI is widely seen as the next productivity revolution, evoking memories of the revival in productivity after the dot-com boom in the late 1990s, as shown below.

Productivity growth set to rise?

Source: Charles Schwab, Bloomberg, as of 6/30/2025.

AI is spawning new categories of products and services, from AI-native software platforms to hardware and infrastructure layers. Chipmakers such as NVIDIA, AMD, and Broadcom have become central beneficiaries of demand for graphics processing units (GPUs) and specialized chips. Cloud providers like Microsoft, Amazon, and Google are spending tens of billions of dollars annually in AI capacity by embedding it into their ecosystems and creating subscription-based revenue streams. It creates a capital expenditure super-cycle resembling the "picks-and-shovels" opportunity of the internet era. Hardware, networking, and software ecosystems all stand to benefit from the virtuous cycle and multiplier effect of AI spending.

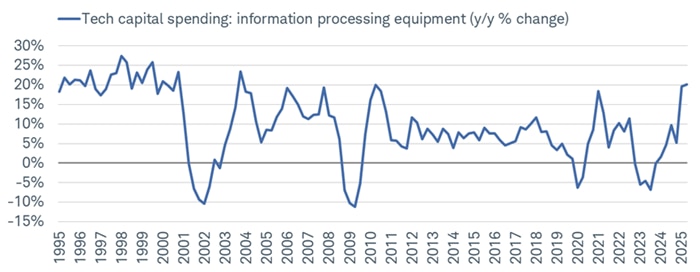

AI-related capital spending has been booming, evidenced by the 20%+ surge for information processing equipment specifically—as shown below. Unsurprisingly, the largest companies are accounting for a growing share of overall capex: the Magnificent 7 (Mag 7) group of stocks now constitutes nearly 25% of the S&P 500's capital spending. Bulls find enthusiasm associated with the move toward Artificial General Intelligence (AGI), which can perform a wide range of intellectual tasks at a human—or even superhuman—level of competence. Unlike today's AI systems, which are typically narrow (specialized in specific tasks), AGI has the ability to understand, learn, and apply knowledge across diverse domains without being explicitly programmed for each one. AGI is expected to bring significant expansions in productivity and wealth creation.

Tech spending on a tear

Source: Charles Schwab, Bloomberg, as of 6/30/2025.

Beyond tech, entirely new industries may emerge, each creating additional incremental markets and opportunities, while also exhibiting strong scale advantages. Training large models requires vast amounts of data, computing power, and of course, capital. Once established, these models are seen as self-reinforcing, creating barriers to entry. Just as Google built a "moat" around search with data and algorithms, or Amazon with logistics, the view is that today's leaders in AI will entrench their dominance. This prospect of "winner-take-most" outcomes has excited investors, since owning the leaders is seen as likely yielding outsized returns as far as the eye can see.

AI models are data-hungry and benefit from scale. This tilts the landscape toward dominant incumbents with deep datasets, computational resources, and global distribution networks. Companies like Microsoft, Alphabet, and Meta have the ability to deploy large language models (LLMs) at scale, integrate them into core products, and monetize them through advertising, subscriptions, and enterprise services. If the market continues to consolidate around a small set of leaders, those with early advantages could continue to enjoy wide moats and outsized returns.

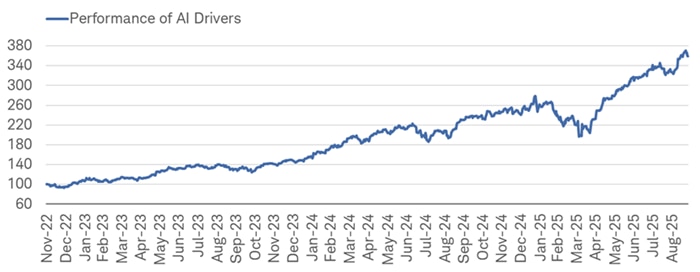

Markets respond not only to fundamentals, but also to narratives. AI has captured investors' imaginations similar to the internet boom of the late 1990s, attracting venture capital, corporate investment, and government subsidies. A basket of AI Drivers—created by our friends at Bespoke Investment Group—tracks the performance of the biggest AI-driven names in the market. As shown below, the group has risen by 259% since the release of ChatGPT in November 2022. That compares to a 63% gain for the S&P 500.

AI, AI, Captain

Source: Charles Schwab, Bloomberg, Bespoke Investment Group (BIG), as of 9/26/2025.

Data indexed to 100 (base value=11/30/2022). An index number is a figure reflecting price or quantity compared with a base value. The base value always has an index number of 100. "AI Drivers" basket includes NVIDIA, Microsoft, Alphabet, Amazon, Meta, Broadcom, Oracle, Palantier, Constellation Energy, GE Vernova, Siemens Energy, NRG Energy, Eaton Corp, Arista Networks, MasTec Inc, Vistra Corp, Quanta Services, Vertiv Holdings, Seagate Technology Holdings, Micron Technology, Western Digital, Samsung Electronics, SK Hynix, Taiwan Semiconductor, CoreWeave, Alibaba Group, TotalEnergies, Baidu. All corporate names and market data shown above are for illustrative purposes only and are not a recommendation, offer to sell, or a solicitation of an offer to buy any security. Past performance is no guarantee of future results.

Investor enthusiasm provides near-term tailwinds for valuations and financing conditions, allowing companies to accelerate development. For AI-bullish investors, momentum itself is part of the case: capital flowing into AI raises the likelihood that transformative breakthroughs occur sooner rather than later. Concerns abound with regard to valuations of AI-related stocks, but with a counter from the bulls that today's AI leaders are extraordinarily profitable, generating massive cash flows. That was decidedly not the case during the dot-com bubble of the late 1990s, when "hope" superseded profits in the denominator of the valuation equation.

The S&P 500's forward price-to-earnings (P/E) ratio has risen sharply from its lows a couple years ago—and is indeed right near a cycle high—but it isn't quite as stretched as it was in the dot-com era's peak. Today's group of interest (the Mag 7) has an average forward P/E of 51.2, whereas the "it group" of 2000 (the Big 5) had an average forward P/E of 60. In fairness, the mega caps have had a stronger gravitational pull this time around, given the rest of the market's average forward P/E is 27 today (compared to 23.9 in March 2000).

AI's expensive taste

Source: Charles Schwab, Bloomberg, as of 8/31/2025.

Big 5 represents Cisco, Exxon, GE, Intel, Microsoft. Mag7 represents Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, Tesla. All corporate names and market data shown above are for illustrative purposes only and are not a recommendation, offer to sell, or a solicitation of an offer to buy any security. Forecasts contained herein are for illustrative purposes only, may be based upon proprietary research and are developed through analysis of historical public data. Past performance is no guarantee of future results.

What say you, bears?

The most immediate concern is valuation. Most AI winners trade at elevated multiples relative to historic trends; with AI-bears warning of a bubble akin to the dot-com era, during which expectations far exceeded realized revenues and profits. While AI will likely continue to transform the economy, the timeline of monetization is uncertain. If adoption proceeds more slowly, near-term earnings may fail to justify market exuberance, leading to sharp corrections.

That is perhaps why, in a recent long-form report on AI, our friend Dario Perkins at TSLombard mused about whether the bubble could be in the "E" in the price/earnings (P/E) equation rather than in the "P." This concern may be justified because of the degree of circularity. Dario used NVIDIA as an example, with its earnings being a "simple aggregation of its customers' massive capital expenditures. If that capex dries up, so will NVIDIA's revenues."

A July 2025 report from MIT's Aditya Challapally, Chris Pease, Ramesh Rasker, and Pradyumna Chari found that 95% of organizations are getting zero return on Generative AI (GenAI), despite widespread adoption of tools like ChatGPT and Copilot. The researchers found that the "core barrier to scaling is not infrastructure, regulation, or talent. It is learning. Most GenAI systems do not retain feedback, adapt to context, or improve over time."

Training and running advanced AI models is enormously expensive, requiring specialized chips, energy-intensive data centers, and large engineering teams. Many applications remain experimental, with unclear paths to profitability. For example, generative AI tools produce impressive outputs but have struggled to convert them into scalable revenue streams. Enterprises experimenting with AI may find productivity gains offset by infrastructure and integration costs. The bear thesis emphasizes that the cost curve may remain high, delaying widespread economic impact.

Although AI models are complex, barriers to entry may not be insurmountable. Open-source models and rapid innovation cycles could erode pricing power. Companies spending billions on proprietary systems may find themselves undercut by cheaper, good-enough alternatives (harkening back to the DeepSeek story of earlier this year). This dynamic could lead to commoditization, squeezing margins in software and cloud services. From the bear perspective, the race to develop ever-larger models risks becoming an arms race with diminishing returns.

Governments are increasingly focused on risks including misinformation, bias, privacy concerns, and potential job displacement. Regulatory scrutiny could slow adoption or impose costly compliance burdens. Public backlash against AI-generated misinformation, including still-high "hallucination" rates (responses generated by AI that contain false or misleading information presented as fact), or automation-driven layoffs could constrain corporate adoption. Bears argue that regulation and social resistance may limit the technology's disruptive potential.

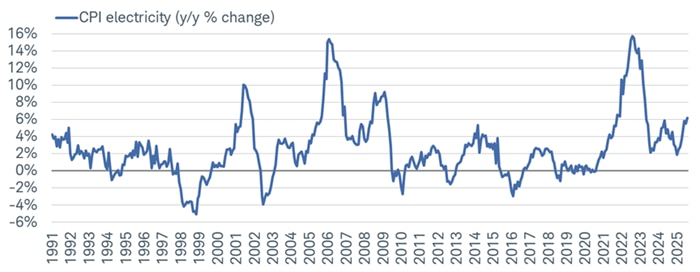

Finally, AI's growth depends on access to key inputs: advanced semiconductors, electricity, and talent. Supply-chain bottlenecks in chip manufacturing, especially given United States-China tensions, could constrain development. Data centers require massive amounts of power, raising questions about sustainability and costs, particularly as energy markets remain volatile. In a higher-interest-rate environment, the capital-intensive nature of AI infrastructure could face financing headwinds. Bears caution that resource constraints may slow the pace of progress relative to optimistic scenarios.

Massive power demands could strain consumers' wallets, especially as electricity prices continue to rise at a quick pace in the post-pandemic world. Shown below, the electricity component of the consumer price index (CPI) is rising at a brisk pace relative to history (outside of major spikes like during the pandemic-induced rupture a few years ago). Interestingly—perhaps annoyingly—the annual change hasn't been near zero since the beginning of 2021—emphasizing the stress consumers are feeling when it comes to their power bills.

Electricity prices still on the rise

Source: Charles Schwab, Bloomberg, as of 8/31/2025.

Where we sit (as non-experts)

AI has emerged as the centerpiece of the U.S. economic growth story—a young but rapidly advancing technology with the potential to transform how the world produces, consumes, and monetizes; much as the internet reshaped the world after the mid-1990s. This prospect of a historic paradigm shift—and the anxiety of being left behind—continues to channel investment capital into AI innovators.

The bull case highlights its ability to drive productivity, create new profit pools, and reward companies with scale and infrastructure advantages. The bear case tempers this enthusiasm with warnings about inflated valuations, uncertain monetization, misinformation generation, regulatory headwinds, and resource bottlenecks.

For investors, the most prudent approach may lie between the bullish and bearish extremes. Exposure to the AI theme is difficult to ignore given its secular potential, but diversification, rebalancing/periodic profit-taking, and valuation discipline are critical. Remember, too, that FOMO (fear of missing out) is not an investment strategy…nor is chasing past performance. In addition, monitoring regulatory developments and cost structures will be essential in determining which companies ultimately capture durable value.

Dario Perkins reminded us of a legendary quote about the dot-com bubble from Warren Buffet's letter to shareholders in early 2001, which is a good way to conclude our report:

"Nothing sedates rationality like large doses of effortless money. After a heady experience of that kind, normally sensible people drift into behavior akin to that of Cinderella at the ball. They know that overstaying the festivities—that is, continuing to speculate in companies that have gigantic valuations relative to the cash they are likely to generate in the future—will eventually bring on pumpkins and mice. But they nevertheless hate to miss a single minute of what is one helluva party. Therefore, the giddy participants all plan to leave just seconds before midnight. There's a problem, though: They are dancing in a room in which the clocks have no hands."

Addendum: We are not stock analysts, but did reference a number of stocks in this report. Please see Schwab Equity Ratings for more information.