5 Steps for Choosing Stocks

A menudo escucho a los inversionistas activos que lamentan el tiempo y la energía que pasan identificando a los candidatos para negociación. Pero con tantas acciones que se pueden elegir (la Bolsa de Valores de Nueva York por sí sola tiene más de 2700), ¿qué debe hacer un operador? Considere estos cinco pasos.

1. Evaluar el mercado

Antes de agregar una posición, observe cómo se está moviendo el mercado en general, ya que la investigación sugiere que aproximadamente el 75 % de las acciones se mueven al ritmo del mercado.1 Al igual que una marea en aumento eleva todos los botes, comprar acciones cuando el mercado tiene tendencia alcista puede aumentar sus probabilidades de una negociación exitosa.

A continuación, observe el promedio móvil de un índice importante (que muestra la tendencia general en los precios durante un período dado) para determinar el impulso del mercado. Por ejemplo, si su plazo de negociación es de dos meses, podría mirar el promedio móvil de 50 días del índice S&P 500® para medir la dirección general del mercado durante ese período.

Preste atención también a posibles eventos que podrían afectar su comercio, como reuniones de política de la Reserva Federal o anuncios de ganancias.

2. Identificar un sector

Una vez que tenga una imagen general del mercado, enfóquese en los sectores e industrias que se vean particularmente prometedores. Un enfoque es hacer un seguimiento del desempeño de cada uno de los 11 sectores definidos por el Estándar de clasificación de la industria global (Global Industry Classification Standard, GICS®) (consulte “¿Problemas en el sector tecnológico?”), para ver cuál se ha destacado en los últimos meses. Si la tendencia indica una posible dificultad en el futuro, es posible que desee centrarse en sectores o industrias con características más defensivas, como Atención médica y Servicios públicos.

También puede ser útil consultar quincenalmente las Vistas del sector de Schwab, que proporcionan una perspectiva a corto plazo para cada sector del GICS.

3. Selección de acciones

Después de encontrar un sector que le guste, es momento de buscar acciones individuales. Los clientes de Schwab pueden utilizar la herramienta de selección, que le permite filtrar por calificación de analista, rendimiento de precio, sector y más (consulte “Selección ahora”, a continuación).

Para reducir la lista aún más, intente enfocarse en los candidatos de crecimiento o valor. Las acciones de crecimiento tienden a tener valoraciones más altas que reflejan el potencial de la empresa, mientras que las acciones de valor tienden a tener precios más bajos en relación con los principios básicos actuales. Si está interesado en el crecimiento, podría seleccionar factores como tasa de crecimiento histórica o proyectada. Si le importa más el valor, puede seleccionar relaciones precio-valor contable bajo o relación precio-ganancia.

4. Revisar los principios básicos

Con una breve lista de candidatos a mano, es hora de profundizar en los detalles. Primero, verifique los comentarios de inversión disponibles para cada empresa. ¿Hay señales de advertencia como una retirada de productos o litigios contra la empresa que podrían afectar negativamente el precio? Por el contrario, ¿existen factores como el lanzamiento de un producto o el anuncio de una adquisición pendiente que sugiera que el precio de las acciones podría aumentar en el futuro?

También puede analizar las ganancias, los estados financieros y las calificaciones de cada empresa (como Schwab Equity Ratings® asignadas a acciones individuales). Sin embargo, no se exceda: El objetivo no es aprender todo lo que pueda sobre cada empresa, sino identificar detalles que podrían distinguir una acción de otra.

5. Revisar los gráficos

Una vez que haya segmentado su lista con los candidatos más prometedores, observe la línea de tendencias de cada acción. En general, es un buen momento para llegar a una negociación si puede comprar durante una tendencia ascendente o, alternativamente, comprar durante una caída si tiene motivos para creer que la disminución es una anomalía.

A medida que adquiere un ritmo con su proceso de selección de acciones, estos pasos deben convertirse en algo natural. Sin importar la metodología que aplique, lleve un seguimiento cuidadoso de sus expectativas y motivos detrás de cada negociación, para aprender mejor tanto de sus fracasos como de sus éxitos.

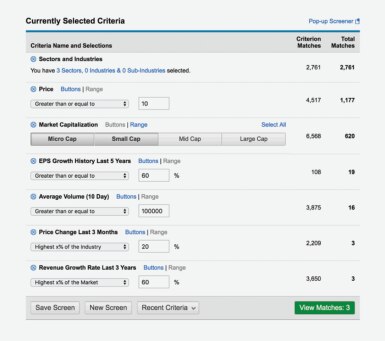

Ahora a seleccionar

Limite su búsqueda con dos herramientas de Schwab.

Los clientes de Schwab pueden iniciar sesión para seleccionar candidatos de negociación utilizando una variedad de criterios, incluyendo métricas de precio, sector y técnicas. Por ejemplo, la siguiente selección busca acciones de menor capitalización bursátil que tienen un crecimiento de ingresos y ganancias superior al promedio y cuya acción del precio supera a su grupo de la industria.

- Como alternativa, los clientes pueden iniciar sesión para comparar el rendimiento entre los sectores y el S&P 500.