Fireworks Ahead: Jobs Data Loom After Record Highs

Published as of: June 30, 2025, 9:14 a.m. ET

Listen to this article

Listen here or subscribe for free to the Schwab Market Update in your favorite podcast app.

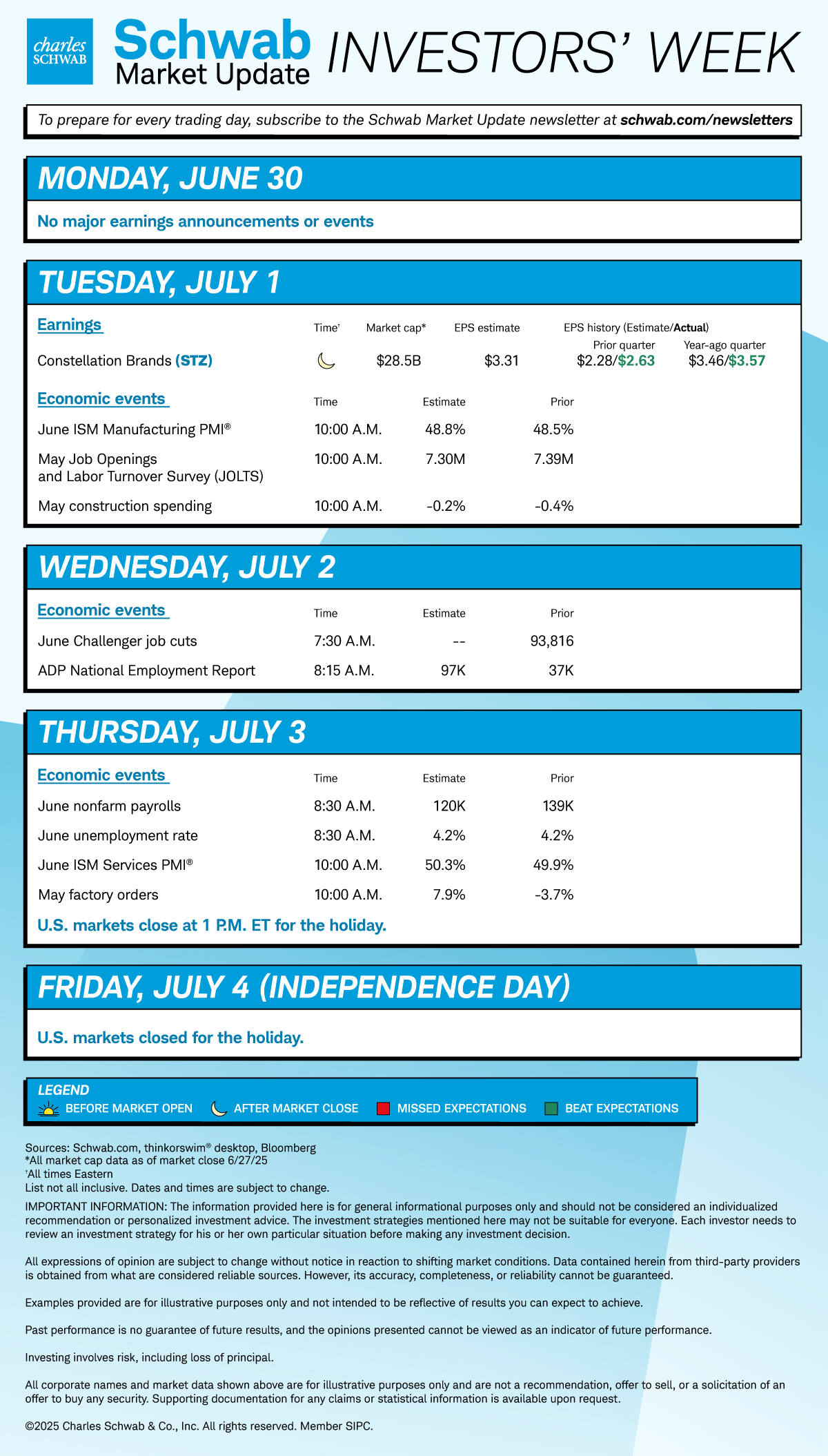

| The markets | Last price | Change | % change |

|---|---|---|---|

| S&P 500® index |

6,173.07 |

+32.05 |

+0.52% |

| Dow Jones Industrial Average® |

43,819.27 |

+432.43 |

+1.00% |

| Nasdaq Composite® |

20,273.46 |

+105.54 |

+0.52% |

| 10-year Treasury yield |

4.26% |

-0.02 |

-- |

| U.S. Dollar Index |

97.31 |

-0.09 |

-0.10% |

| Cboe Volatility Index® |

17.12 |

+0.80 |

+4.9% |

| WTI Crude Oil |

$65.37 |

-$0.15 |

-0.23% |

| Bitcoin |

$108,205 |

+$720 |

+0.67% |

(Monday market open) This short holiday week could punch above its weight. Markets close early Thursday and shut completely Friday, but a host of jobs data arrives before that. It all builds up to Thursday's June nonfarm payrolls report, with job growth forecasts on the low side near 120,000.

Beyond jobs, several Federal Reserve speakers share thoughts today and Fed Chairman Jerome Powell participates in a panel discussion early tomorrow. In Washington, D.C., the Senate prepares for a marathon voting session today, and hopes for a quick resolution played into early market strength. Canada said today it's dropping the digital services tax that caused President Trump to terminate talks with the country and threaten higher tariffs. Separately, Bloomberg reported that Trump threatened a 25% tariff on Japanese cars and that France is confident the European Union can make a deal with the U.S. before the July 9 deadline

Markets confidently entered the ring this morning after the old week ended with new record highs for the S&P 500 index above 6,170 spurred by trade optimism, technical strength, a Middle East ceasefire, dovish Fed comments, and improved investor sentiment. The market has now erased all the tariff-related losses it suffered in March and April, taking just 55 days to march back from its trough to Friday's fresh peaks. "Fear and uncertainty have come down countless notches from where we were," said Alex Coffey, senior trading and derivatives strategist at Schwab. "Historically the first few weeks of July are some of the most bullish of the year."

To get the Schwab Market Update in your inbox every morning, subscribe on Schwab.com.

Three things to watch

- Slower growth doesn't guarantee July rate move: Jobs data could help shape the Federal Reserve's next decision a month from today, though it might take a very poor showing to push policy makers into a July rate cut. Checking overall economic health, recent data point to slower growth after the pre-tariff bump in spending, and that was reflected by the Atlanta Fed's GDPNow meter falling to 2.9% Friday for second quarter gross domestic product (GDP) growth from the previous 3.4%. "Personal income and consumption were both lower in the past month, and survey data point to wariness by businesses about consumer spending holding up," said Kathy Jones, chief fixed income strategist at Schwab. "Sentiment figures also remain weak as geopolitical concerns and uncertainty about trade and tax policies weigh on optimism." Jones sees the economy slowing and expects one to two Fed rate cuts this year starting in September. She also thinks if tariffs remain at the current 15%, prices of consumer goods will rise, and she thinks the yield curve will continue to steepen. Higher long-term yields implied by a steeper curve would spell little relief from elevated borrowing costs weighing on big purchases.

- What to watch as tariff deadline nears: The administration has indicated it might extend its July 9 deadline for countries negotiating "in good faith," but that's a judgment call and investors have little insight into negotiations. "The president may be looking for wins," said Michelle Gibley, director of international research at the Schwab Center for Financial Research. "He declared deals with the U.K. and China as wins despite both being thin on substance. We could get a flurry of trade frameworks—broad-based outlines for what would be covered in trade deals—which could allow some countries to keep tariffs at the current rates while trade deals are sorted out after July 9." Investors still await U.S. announcements on pharma and semiconductor tariffs, and pharma makes up 25% of all European Union exports to the U.S. Market volatility could rise as the deadline closes in. But on a positive note, The Wall Street Journal raised hopes of a resolution late last week, reporting that the EU is considering lowering tariffs.

- Budget negotiations update: The Senate is moving towards a final vote on the "One Big Beautiful Bill." A series of votes on dozens of amendments will begin this morning and is likely to last late into the night and possibly into Tuesday. "Republican leaders are confident the Senate will pass the bill," said Michael Townsend, managing director of legislative and regulatory affairs at Schwab, "though some senators are still pushing for changes even as voting begins." The House is reconvening on Wednesday to vote on the Senate version of the bill, hoping to send it to the president by Friday. But House passage is not a slam dunk. "The Senate changes to the bill that the House passed in May are substantial," said Townsend, "and both conservatives and moderates have concerns. But intense pressure from the White House is likely to push the bill across the finish line." The legislation would raise the debt ceiling by $5 trillion, taking an issue that tends to spark market volatility off the table until at least 2027.

On the move

Nike (NKE) slipped early Monday but soared 15% Friday as earnings came in slightly better than expected and the company's forecast soothed investors.

Enphase (ENPH) dropped nearly 2% and SolarEdge (SEDG) slipped ahead of the open as the latest version of the Senate's budget bill contained more bad news for the solar energy sector, phasing out tax credits by the end of 2027. But Sunrun (RUN) is up 6% in the early going on hopes that rooftop solar could continue getting tax credits. And First Solar (FSLR) climbed 8% as the Senate bill taxed solar components from China. Volatility could continue as Congress continues to work on the budget.

Hewlitt Packard Enterprise (HPE) jumped 15% and Juniper Networks (JNPR) climbed 8.5% in pre-market trading. The Justice Department settled a lawsuit challenging HPE's $14 billion acquisition of the wireless networking solutions provider, Barron's reported.

Moderna (MRNA) popped more than 4.5% in the pre-market hours as the company announced positive Phase III trial results for its flu vaccine, which could pave the way for a combination flu and Covid shot.

Nvidia (NVDA) inched higher in pre-market trading after setting another new all-time high Friday. However, the Financial Times reported that insiders at Nvidia have sold $1 billion worth of company stock in the last year.

Walt Disney (DIS) climbed 1.8% this morning after receiving an upgrade to Buy from Hold at Jefferies. The analyst said there's less risk of a theme park slowdown and said the cruise business has positive upside.

Tesla (TSLA) fell 1% early Monday, hurt by proposals in the budget bill to cut clean energy credits. Investors await Tesla's quarterly deliveries data expected this Wednesday.

Palantir (PLTR) climbed 4% ahead of the open after announcing a partnership with Accenture (ACN) to provide AI-powered solutions to address operational challenges at federal agencies.

Bitcoin (/BTC) inched up 0.7% and crypto-related stocks Coinbase (COIN) and Strategy (MSTR) both rose around 1% ahead of the open. Last week, the Federal Housing Finance Agency (FHFA) ordered Fannie Mae and Freddie Mac to begin preparing to accept cryptocurrency as an asset for single-family mortgage loan risk assessments.

The Cboe Volatility Index (VIX) rose nearly 5% even as major indexes climbed. Sometimes a rising VIX—which means growing uncertainty—can hurt the stock market. When both rise, one often ends up turning back.

As of early Monday, odds of a July rate cut were 21%, according to the CME FedWatch Tool. The likelihood of at least one rate cut by September was 93%.

Heading into the last day of June, the S&P 500 is up 4.4% this month and the Nasdaq Composite is up nearly 6.1%. The Dow Jones Industrial Average is up 3.7%.

Market breadth—which can help pinpoint investor sentiment—improved somewhat last week. By late Friday, the number of S&P 500 stocks trading above their 200-day moving averages jumped to 54.8% from 48.4% a week earlier.

The S&P 500's relative strength index (RSI), a momentum measure, got a bit warm Friday, climbing into what's traditionally seen as overbought territory above 70. This could imply a near-term "digestion of gains," said Nathan Peterson, director of derivatives analysis at the Schwab Center for Financial Research.

More insights from Schwab

Trend tracker: Analysts often discuss "market breadth," but what does it mean and how can you track it? In the latest Schwab analysis, learn more about different breadth measures and how to find them through Schwab's tools. Combined with other measurements, breadth can indicate potential sentiment trends and shifts, helping market participants pinpoint hot or cold spots.

" id="body_disclosure--media_disclosure--150091" >Trend tracker: Analysts often discuss "market breadth," but what does it mean and how can you track it? In the latest Schwab analysis, learn more about different breadth measures and how to find them through Schwab's tools. Combined with other measurements, breadth can indicate potential sentiment trends and shifts, helping market participants pinpoint hot or cold spots.

Mid-year "muni" update: Tax policy took center stage in the municipal bond market during the first half of 2025 and could continue to in the second half, wrote Cooper Howard, director, fixed income strategy at the Schwab Center for Financial Research, in his latest analysis. At the same time, issuance has soared but could moderate. "Partly as a result of the surge in issuance, munis were the worst-performing asset class among all the major sectors we track during the first part of the year," Howard noted. "Going forward, if issuance moderates, as we expect it will, total returns should recover."

Chart of the day

Data source: FTSE Russell. Chart source: thinkorswim® platform.

Past performance is no guarantee of future results.

For illustrative purposes only.

The Russell 2000® (RUT—candlesticks) small-cap index missed it by that much Friday, closing two points below its 200-day moving average of 2,174. "The near-term technical outlook is bullish, but it probably makes sense for the RUT bulls to wait for a couple of closes above the 200-day simple moving average before declaring victory," said Schwab's Peterson.

The week ahead